Wednesday, April 20, 2011

Home Loan Volumes Down

Q1 defects

THE developer of the Gold Coast's Q1 supertower is being sued over construction defects that allegedly have left the building requiring millions of dollars worth of repairs.

Only six years after its completion, the world's tallest residential building allegedly is riddled with corrosion.

Sunshine Coast Troubles

Despite bids on 30 of the 36 units none was sold, although post auction talks continued later yesterday. Reed Property chief executive Ken Reed said the market was soft. “It’s a buyer’s market. Conditions on the Sunshine Coast are not too different from elsewhere in south-east Queensland,” he said.

An opening bid of $65,000 for an 88 square metre one-bedroom unit was the lowest offer made. One of the 512sq m penthouses attracted a maximum bid of $600,000 after it was listed for $1.58 million. Kings Beach residents Deborah and Jeff Taylor said the event was “a fizzier”. “The marker is so depressed at the moment. Things are selling for prices you wouldn’t believe. There are so many units on the market around here at the moment,” Mrs Taylor said.

The $65 million tower has access to a Greg Norman-designed championship golf course, pools, tennis courts and a gym."

Monday, April 18, 2011

Changes to Lot Entitlements for Some Apartments

After being approved by Queensland Parliament on the 6 April 2011, the Body Corporate and Community Management and Other Legislation Amendment Bill 2010 received Royal Assent on 14 April 2011, meaning that the new legislation is now in force. The new legislation will introduce a number of matters including:

- New principles to be used when determining Contribution and Interest Schedule Lot Entitlements

- A process where owners, who have been affected by a Lot Entitlement change, can submit a motion to the Body Corporate Committee before the 14th April 2014 to revert back to the Lot Entitlement Schedule before the change was made

- Additional requirements for Disclosure Statements and rights of termination

- Introduction of a new "Two Lot Scheme" module to make management of these smaller schemes much less onerous for their owners

Sunday, April 17, 2011

Madison Heights Bowen Hills

Saturday, April 16, 2011

Milton Park

Brisbane City Council’s plan to turn the old Milton Tennis Centre site into parkland is set to benefit surrounding properties, with The Milton the only major new development now on the horizon, says a leading property researcher.

Michael Matusik, director of Matusik Property Insights, said council’s plans to resume the 3.5 hectare site for suburban parkland would reduce the future supply of new apartments in the suburb by about 670, increasing the ‘scarcity value’ of stock in Milton.

Mr Matusik said, along with the reduction in supply, homes and apartments in Milton would benefit from a three to five per cent price premium generally afforded to properties within a one kilometre radius of major parkland.

“The single most common feature of any metropolitan area’s position as a desirable residential address is trees, and while buyers want to be in close proximity to the city, public transport and amenities, they still want access to green open space.

Mr Matusik said the significant reduction in future supply as a result of the development of the parkland at the old Milton Tennis Centre site would put increased demand on new and existing property in the suburb.

The 30-level The Milton, which is anticipated to begin construction this year, will feature 298 one and two bedroom apartments, most with views of the CBD or Brisbane River, along with a ground floor retail promenade and commercial office space."

My comment: The proposed park is some time off. It is located on the other side of the railway and the other side of Milton Road to that of FKP's development. So I don't think it will have much impact to people's decision to decide to rent or buy on a development near the Milton Railway Station, that has views of the brewery.

Rental Yields

"Demand for rental homes in resource-rich regions of Queensland is continuing to drive up residential rental yields in some mining areas, according to the Real Estate Institute of Queensland (REIQ).

The REIQ residential rental yield report found that over the December quarter 2010, the postcodes of Dysart, Blackwater and Moranbah in Central Queensland recorded gross yields between 14.5 and 8.9 per cent because there remains more demand than supply for rental homes in many of these mining areas.

Across the state, however, the market conditions of the past 12 months has resulted in more sustainable gross rental yields given property prices have generally softened and rents have remained stable.

Australian Bureau of Statistics (ABS) figures show that investor numbers in Queensland increased in February compared to January however numbers remain at historic lows."

For apartments and townhouses:

Recent Auctions

- 2602/108 Albert St (Festival Towers) - 2 bedrooms - one of the better apartments in the building - withdrawn from auction and now listed at "over $500,000"

- 110/540 Queen Street (Willahra Tower) - studio - failed to sell - highest bid was a vendor's bid of $175,000

Thursday, April 14, 2011

Market Cracks

Apartment prices in the luxury beachside Australian town of Noosa Heads have tumbled by a fifth since 2008 as cracks emerge in a housing market that’s so far escaped the rout seen in the U.S., U.K. and Ireland.

The median apartment price in the tourism and retiree town 150 kilometers (93 miles) north of Brisbane has slumped 21 percent in three years to A$570,000 ($594,000), according to the Real Estate Institute of Queensland. Sales have more than halved across Queensland state’s Sunshine coast, home to “Crocodile Hunter” Steve Irwin’s Australia Zoo, and the Gold Coast, known for its surfing beaches and casinos.

“We have a very overvalued housing market and even a small adverse shock can be magnified by a large adverse impact on property values,” said Gerard Minack, Sydney-based global developed markets strategist at Morgan Stanley (MS), who asserts Australian home prices are as much as 40 percent overvalued. “We’re seeing that now in parts of Queensland.”

The Rental Market in Brisbane

This is an extract from a real estate agent's newsletter who sells inner city apartments:

"Where does that leave the rental market??

Going up, up, up – as many people are forced to wait much longer than they had hoped or expected for rebuilding to commence and renovations to be completed. Almost 8,000 homes were inundated by the January floods, and another 10,000 homes were partially affected. This means that the homes of almost 40,000 people would have been somehow affected!

“The increasing demand (for rental properties) us likely to create upward pressure on rental rates as those displaced persons look for temporary accommodation over the next 6-12 months”, according to recent RPData report on the effects of the floods on the housing market. “The issue is that rental houses will be in short supply and many may have to opt for a unit instead.”

Tuesday, April 12, 2011

Tennyson Prices

Sunday, April 10, 2011

From the USA

Trilogy Definitely Not Going Ahead - One less hotel for Brisbane

The Trilogy building, which was to be a mix of apartments, offices and a Mirvac hotel, is officially dead.

Despite reportedly good off-the-plan sales, it is now reported that the current owners of the land are selling to a Melbourne developer who will build an office tower on the site. This may impact some of the views from Aurora?

See Brisbane Times

Recent Sales

- Quay West, apartment 1506, 2 bedroom, sold last week, reportedly very close to listing price of $775,000

- Quay West, apartment 1505, 1 bedroom, sold last week, listing price $465,000

- Arbour on Grey, apartment 2302, 2 bedrooms, sold at auction yesterday for $611,000 according to APM

- Parklands Pinnacle, apartment 6017, 3 bedrooms, failed to sell at auction, sold after for $1.3M

Buyers Market

- The Courier Mail makes money from property advertisements and thus tries to have positive stories about the property market and its advertisers (i.e., real estate agents). This Saturday's Courier Mail had no stories about residential real estate at all.

- Real estate agents are returning my calls when I say that I am looking to buy. I even have agents offering to be a buyers agent for me.

- In relation to sales in apartment buildings that I follow, for sales this month, the prices are flat or going backwards (10% to 20% declines in sales prices for comparable apartment property sales, compared with sales prices from six months ago). There are some exceptions to this.

Flat

Friday, April 8, 2011

Only Modest Gains

Sunday, April 3, 2011

Rate Your Agent

What happens when property values correct

Thursday, March 31, 2011

Admiralty Two and Mosaic management rights for sale

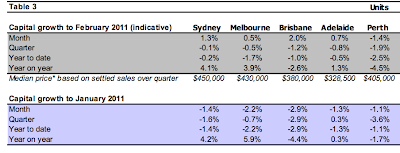

Housing Flat in February - almost no growth over past year

From RP Data Press Release today:

After a natural disaster-affected January (-1.5 per cent seasonally-adjusted or -0.7 per cent raw), RP Data-Rismark's Hedonic Index reports that Australian home values held ground during the month of February.

In the capital cities, RP Data-Rismark recorded flat dwelling values (0.0 per cent seasonally-adjusted or a slightly stronger +0.7 per cent in actual 'raw' terms). The 'rest of state' areas, which account for the 40 per cent of homes not located in the capitals, also displayed some improvement during February with house values rising by 0.5 per cent seasonally-adjusted (+0.3 per cent raw).

Over the 12 months to end February, Australia's capital city home values have hardly moved, rising by only 0.8 per cent. The story is the same in the rest of state regions, where home values remain unchanged (-0.2 per cent) over the last year.

In the property investment market, RP Data-Rismark estimate that gross apartment and detached house yields were 4.8 per cent and 4.2 per cent, respectively, in February. Darwin (5.7 per cent), Canberra (5.3 per cent), Sydney (5.1 per cent) and Brisbane (5.1 per cent) all offer reasonable rental yields in the apartment market. Melbourne is the laggard at 4.2 per cent. ...

A (near) double interest rate hike in November 2010 combined with numerous natural disasters has conspired to make the last three months difficult ones for Australia's housing market. ... While the weakness has been evidenced right across the nation, it has been especially acute in Darwin (-9.0 per cent) and the two resource-centric capitals, Brisbane (-3.3 per cent) and Perth (-1.9 per cent).

"Recent RBA analysis also shows that repossessions have been highest in Perth and South East Queensland, which helps explain the poor performance seen in these states. Indeed, Perth home values remain 0.7 per cent below their December 2007 levels", Mr Kusher added.

Over the 12 months to February, Sydney (+3.3. per cent), Melbourne (+2.5 per cent), Canberra (+0.7 per cent) and Adelaide (+0.6 per cent) have ground out modest capital gains. In contrast, Brisbane (-5.3 per cent) and Perth (-4.1 per cent) have experienced more material corrections. ...

According to RP Data's Mr Kusher, the key leading indicators indicate that capital growth is likely to remain very subdued for the time being, as Rismark and RP Data have previously forecast.

"Auction clearance rates have been a little weak, the number of homes advertised for sale is at the highest level it has been since we started collecting this data, and other lead indicators, such as the time it takes to sell a home, and the margin by which vendors have to discount their properties, are climbing again after reaching a plateau in recent months. Conditions are certainly in the favour of prospective investors. The large stock of homes available for sale should afford potential buyers increasing scope to negotiate on price and get the best possible deal," Mr Kusher said.

Tuesday, March 29, 2011

Yield

Given the past performance and recent volatility of the rental market, which has occurred despite low vacancy rates, investors should be factoring both negative and positive rental-growth scenarios when making purchasing decisions.

Prospective off-the-plan buyers should also consider what kind of apartment stock and how much is planned in their immediate area, which could affect demand and rental levels by the time their unit is put on the market."

From Domain

Sunday, March 27, 2011

How Many Apartments for Sale in Brisbane?

- Quay West: 4 apartments for sale (two 2 beds; two 1 beds).

- Admiralty Quays: two 2 beds

- Admiralty Towers: one 2 bed at rear

- Admiralty Two: one 2 bed; one three bed

- Arbour on Grey: 2 apartments for sale (one 2 bed; one 3 bed).

- Saville SouthBank: zero

Wednesday, March 23, 2011

Soul Settlements Coming Up

Soul off-the-plan purchasers in the low rise section are getting ready for settlement. Soul is located at Surfers Paradise, in a prime location. It is a very high end high rise. Photo from March showing progress.

Valuers and banks for purchasers are looking at contracts and doing valuations. I have heard of a situation where the apartment was valued at 70% of the contract price. That may not seem to bad, but if the contact price is $2M, then the purchaser needs to find an extra $600,000 to settle.

And there has been no announcement of who will manage this complex.

Will Juniper survive, or head the same way as Raptis and Niecon?

One purchaser is trying to resell his 2 bed apartment for more than a 3 bed apartment is being valued at: www.soul-apartment.com/

Tuesday, March 22, 2011

Developments at Portside

Properties Advertised For Sale

Takeover Bid For Oaks

Rough Ride For Property

At the other end of the auctioneer's hammer, stubborn vendors are reluctant to reduce prices."

See Domain

Saturday, March 19, 2011

Tennyson Reach - Legal Decisions

"As already noted, Mr Cox values the apartment at $1,500,000 and said that its value would have been $1,750,000 had the view been the equivalent of that from the display centre. " Mirvac v. Holland

"The defendant [Mirvac] is in possession of the apartment. After the flood, it removed the mud. The walls of the apartment consisted of Gyprock sheeting. The defendant removed the lower level of the Gyprock, which was flood affected. Wiring was disconnected; switches were removed and piled into a heap; appliances were disconnected. Dunworth v. Mirvac

"It is that the area of a part of the actual Lot varies by more than five per cent from the area depicted upon the drawing for that part. In this case the area of each of the balconies varies from what was shown within the original drawing by, in one case, 10.35 per cent and in the other by 15.30 per cent. Because clause 6.3(a) of the proposed (and actual) contract permitted a change up to five per cent to the “size of the Lot or any part of the Lot” it is argued that these changes made the actual Lot different from the proposed Lot as originally identified." Mirvac v. Beioley

Q1 Legal Decision - Purchaser Looses Large Deposit

Top End Brisbane Apartments

Tuesday, March 15, 2011

Another Dog Decision

Riverpoint Flood Clean Up

The body corporate has prepared a damage report and a preliminary estimate of costs for the clean-up, hire of plant and equipment, purchases involved in the clean-up, temporary electrical power and supply, pump equipment, rubbish disposal, repairs to the electricity supply and switchboards, repairs to ducting and air-conditioning, replacement of pumps and sensors, repairs to sewer and stormwater pumps, repairs to 8 lifts and replacement of lift equipment, pool pumps, entry roller door, fire doors, painting and “miscellaneous.”

The total estimate is $551,341.35 including supervision and co-ordination of the repairs, exclusive of GST."

See decision regarding Riverpoint at West End.

Tennyson Reach Clean Up

Oaks Dives

Sunday, March 13, 2011

Noosa

As pressure mounts on sellers some under siege from banks prices of homes in the iconic playground for the rich and famous have dropped.

Prominent agent Tom Offermann said that for "those with confidence" this was a defining moment. "You can buy well and reap the rewards," he said. "Stock is up 20 per cent on normal levels, buyers are down about 30 per cent and there's good value."

Mr Offermann said the reason behind the downward shift was that Noosa had a high concentration of "discretionary properties" holiday and investment homes that people looked to dispose of in uncertain times. However, he said the area coped better than other hotspots and would bounce back faster.

Mr Offermann's agency recently sold a duplex apartment at 2/11 Mitti St, Little Cove, for $2.015 million for sellers who had acquired it in 2006 for $2.43 million a reduction of 17 per cent.

A stunning waterfront unit in Las Rias on Noosa Sound is listed at $1.95 million 22 per cent below the 2008 value of $2.5 million."

Saturday, March 12, 2011

New Developments Blog

Mirvac at Portside

Gold Coast Sinking Under Apartments Glut

- 2000 apartments worth an estimated $2 billion listed for sale

- few buyers

- dire oversupply

- only 300 apartments are selling on average each year

- between 5 and 7 year supply of apartments

- high asking prices and a reluctance by banks to lend had compounded the oversupply problem

- NAB less likely to lend to the Gold Coast apartment market

- Mr Korda, receiver for The Oracle, estimates average apartment price for the past 10 years has been about $400,000, while the average price for an Oracle unit is $1.2M.

- Soul will add to the glut, where the average asking price for the top third of the 77 storey building is $3.87 million.

- "If you have a $1 million apartment, you could probably only get bank finance for $360,000" Mr Korda said.

- Its a price point and liquidity issue.

Friday, March 11, 2011

REIQ Sales Report

| Region | Median Sale Q4.10 | Qtrly change | Median Sale 12mths Q4.10 | Median Sale 12mths Q4.09 | 1yr change |

| BNE (SD) | $380,000 | 1.3% | $379,950 | $362,000 | 5.0% |

| BNE (LGA) | $400,500 | -1.8% | $407,000 | $386,500 | 5.3% |

| AUCHENFL | $447,500 | 4.1% | $430,000 | $430,000 | 0.0% |

| BNE CITY | $485,000 | -4.9% | $460,000 | $423,500 | 8.6% |

| CHERMSIDE | $415,000 | 8.1% | $426,250 | $407,500 | 4.6% |

| The VALLEY | $375,500 | -4.9% | $400,000 | $402,500 | -0.6% |

| INDO | $460,000 | 2.4% | $465,000 | $435,000 | 6.9% |

| KANGAROO PT | $408,000 | -25.8% | $505,000 | $450,000 | 12.2% |

| NEW FARM | $531,500 | 4.2% | $525,000 | $460,000 | 14.1% |

| PADDO | $407,500 | N/A | $420,000 | $444,000 | -5.4% |

| Sth BNE | $472,500 | 2.3% | $445,000 | $399,250 | 11.5% |

| SPRING HILL | $391,063 | 10.9% | $390,000 | $390,000 | 0.0% |

| ST LUCIA | $447,065 | 5.2% | $440,000 | $448,750 | -1.9% |

| TARINGA | $427,500 | -2.8% | $426,750 | $399,500 | 6.8% |

| TOOWONG | $407,000 | -4.3% | $435,500 | $415,000 | 4.9% |

| WEST END | $520,000 | -3.0% | $530,000 | $509,000 | 4.1% |