Brisbane Apartments Q4 Research Report that focuses on off-the-plan sales in the inner Brisbane area.

"Transaction activity in the new Inner Brisbane Apartment market is currently being driven principally by demand from investors. Recently owner-occupiers have been largely absent from the market due in part to expectations of flat prices in the short to medium term, higher borrowing costs and the removal of fiscal stimulus measures.

Currently investors are accounting for 80-90% of all transactions in the new Inner Brisbane apartment market. Investor demand - which is driven largely by rental return and expected capital appreciation - is even stronger for affordable stock (less than $650,000). Notably, the market generally is strong for price-pointed affordable stock.

Returns, which ultimately drive transaction activity for investors, are highly sensitive to both rental values and borrowing costs. Currently, both of these variables are delicately balanced, with rental values sensitive to current and future levels of supply and borrowing costs dependent on the bank’s cost of capital and macroeconomic factors such as inflation. In the near term, investor returns are likely to be driven by rental income rather than capital growth.

Given the current market imbalance, stemming mostly from elevated supply in Inner Brisbane, owner occupiers have become increasingly cautious before committing to purchase. In addition, there is now less urgency to purchase as the strong levels of capital growth witnessed in recent years have dissipated.

Despite the aforementioned threats to performance, the fundamentals of the new Inner Brisbane apartment market remain reasonably solid and underlying demand has held up well. This is reflected by the number of unconditional sales over 2010, which are well above trend levels. However, the ability and/or willingness of both investors and owner-occupiers to purchase has been eroded by increased borrowing costs and expectations in the near term of flat prices and limited rental growth. Whilst some rental markets will be influenced in the short term by home owners displaced by the floods, a sustained increase in tenant demand will be required to deliver solid levels of rental growth.

The annual demand for new apartments in Inner Brisbane is rising, as reflected by the number of unconditional sales reported during 2010 (1,433). The number of transactions in the year to December 2010 is now at its highest level since December 2005 and is well above the long term average for this market. Similarly, demand continued at trend levels over the final quarter of 2010, with 339 unconditional sales.

On the supply side, the number of new apartments available for sale in Inner Brisbane rose to 2,228 during Q4 2010, representing an increase of 24% from the previous quarter. More importantly, available supply is now at its highest level in over 10 years and is well above previous highs observed in 2002 and 2004 (circa 1,500 apartments). Current levels of available supply in Inner Brisbane represent 19 months of demand, based on the average number of unconditional sales witnessed over 2010.

Like many property markets – both residential and commercial - the New Inner Brisbane Apartment market is experiencing the impacts of a misalignment between the business cycle and development cycle. Economic conditions turned down sharply in 2009 and are yet to fully recover, whilst the supply pipeline has retained its strength, resulting in a significant market imbalance.

Most of the new apartments currently for sale in Inner Brisbane are located in the CBD and Inner North, which account for 34% and 41% of the total respectively. Additionally, when we include our estimates of apartments which are likely to be released during 2011, the Inner North and CBD continue to account for the largest share of supply.

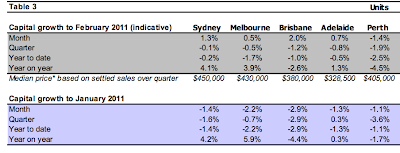

The weighted average price of unconditional sales has been trending downward since late 2008. Despite above trend levels of demand during 2010, prices have continued to fall, although the pace of decline has eased significantly. Continued recent falls in the weighted average sale price are a reflection of the large proportion of price pointed affordable stock that transacted during 2009 and 10. The weighted average price of unconditional sales for Inner Brisbane during Q4 2010 was $556,200, a moderate increase from the previous quarter.

The unconditional sales of new apartments in Inner Brisbane during Q4 2010 were comprised largely of affordable stock, with 84% of transactions involving properties less than $650,000 in price. More specifically, 42% of the unconditional sales in the fourth quarter involved properties less than $450,000 in price. Evidently, purchasers continue to be very price conscious and this trend is likely to continue in the near term. Fourth quarter transactions in Inner Brisbane were dominated by one and two bedroom stock, with each category accounting for 45% of the unconditional sales reported.

The number of unconditional sales in the Brisbane CBD rose substantially over the final quarter of 2010, increasing to 94, which is more than twice the average witnessed during 2010 (45). Most of the sales were achieved by Meriton projects, with Infinity and Soleil accounting for 61 and 30 sales respectively. Furthermore, the majority of transactions involved two and one bedroom apartments, with 65% and 21% respectively of the total. The CBD precinct achieved 28% of the sales reported for the new Inner Brisbane Apartment market during Q4 2010 and 12% of the 2010 total. In annual terms there were 179 unconditional sales for the Brisbane CBD during 2010.

The CBD precinct represents a large component of available supply in Inner Brisbane, with 34% of the total (758 apartments). Supply levels are expected to rise substantially during 2011 due to the expected release of some 875 units.

Future Projects

Colliers International Research has estimated approximately 4,000 apartments will be released within Inner Brisbane during 2011.

Approximately 45% of this supply is expected to be located within the Inner North precinct. Madison on Mayne will release the largest number of apartments to the market (286).

The CBD precinct is likely to receive 21% of the potential supply with Camelot providing 420 apartments.

Resales of Existing Apartments

- During the third quarter of 2010, the number of apartments (new and established) which settled in Inner Brisbane fell by 12% to 1,191.

- The number of settlements in Q3 2010 was significantly lower (-23%) than the equivalent quarter of 2009 (1,357).

- Buyers continue to be very price conscious, as reflected by the large number of settlements involving affordable stock, with almost 80% involving apartments less than $600,000 in price."