"With lower interest rates and home value growth remaining moderate we would expect that the basis point spread between official interest rates and gross rental yields on houses to increase further over the coming months which would subsequently make investing in housing potentially even more attractive for those investors focussed on yield."

See Why Are Investors Returning to the Housing Market?

Showing posts with label rent. Show all posts

Showing posts with label rent. Show all posts

Saturday, May 18, 2013

Saturday, February 23, 2013

Bubble Trouble?

"In conclusion, the data presented should provide more than enough evidence to suggest that Australia’s residential property market (specifically land market) is vastly overvalued, driven by debt-financed speculation and the relative non-taxation of land rent. While land bubbles have been a continual feature of the Australian economy, what separates this cycle is the relative enormity of the boom in both land values and private debt. A smaller private debt to GDP ratio during the 1880s and 1920s was enough to produce two devastating depressions, including a number of recessions during the mid-1970s, early 1980s and early 1990s."

See The History of Australian Property Values

A response to this is on Property Observer, plus a debate here.

See The History of Australian Property Values

A response to this is on Property Observer, plus a debate here.

Wednesday, February 6, 2013

Rental Demand Strong, says REIQ

Extract from REIQ Press Release:

Demand for rental properties remained strong across Queensland during the last three months of 2012, according to the Real Estate Institute of Queensland (REIQ). Results from the REIQ December vacancy rate survey, released today, found that rates remained tight during what is historically the lowest period for rental demand annually. REIQ CEO Anton Kardash said Queensland’s rental market had been a story of more demand than supply throughout 2012.

“As the year progressed, it became apparent that the continued robust demand for rental properties was not going to ease anytime soon. While sales in the property market did begin to improve in the second half of last year, the removal of the First Home Owners Grant in mid-October resulted in a large number of would-be home buyers remaining in the rental market at the tail-end of last year.”

According to the latest Australia Bureau of Statistics (ABS) housing finance figures, the numbers of Queensland first home buyers slumped 33 per cent between October and November last year.

At 2 per cent, the REIQ figures showed that Brisbane’s vacancy rate remained well under the level of a balanced rental market at the end of December.

Demand for rental properties remained strong across Queensland during the last three months of 2012, according to the Real Estate Institute of Queensland (REIQ). Results from the REIQ December vacancy rate survey, released today, found that rates remained tight during what is historically the lowest period for rental demand annually. REIQ CEO Anton Kardash said Queensland’s rental market had been a story of more demand than supply throughout 2012.

“As the year progressed, it became apparent that the continued robust demand for rental properties was not going to ease anytime soon. While sales in the property market did begin to improve in the second half of last year, the removal of the First Home Owners Grant in mid-October resulted in a large number of would-be home buyers remaining in the rental market at the tail-end of last year.”

According to the latest Australia Bureau of Statistics (ABS) housing finance figures, the numbers of Queensland first home buyers slumped 33 per cent between October and November last year.

At 2 per cent, the REIQ figures showed that Brisbane’s vacancy rate remained well under the level of a balanced rental market at the end of December.

Sunday, January 27, 2013

An agent's view on inner city apartment rentals

"There’s now fewer rental homes in our CBD than we had in 2006, according to new data on Brisbane’s housing market. The Residential Tenancies Authority stats for the December quarter show our CBD rental pool shrank yet again.

The RTA track all rental bonds and in Brisbane CBD and Spring Hill the total has reduced by 700 since its 2007 peak. For example for the full year 2012 the rental pool in postcode 4000 grew by a miserly 3 homes, despite the completion of Adelaide Street’s “Soleil Tower” with 464 apartments.

And there’s no large additions to the rental pool on the horizon. There’s just one big tower under construction in the CBD but it’s a long way from completion. So we’d expect it’s going to be well into 2014 before we see any worthwhile increase in supply.

Despite this we haven’t yet seen any big jumps in rent and 2012 finished with a modest 3% growth in Brisbane’s rents. Our team [at Bees Nees] and other real estate agents are reporting a busy January market and we’re overall optimistic. But renewing tenants are generally not agreeing to big rent increases and rent affordability remains top of mind. Inner city tenants do often move further out to save money. Landlords are still cautious too and they don’t want to risk a vacant home. So it looks most likely that 2013’s rent rises will be steady.

As a sidenote we often see new apartments being sold off-plan with forecast rents that must have some large increases expected on today’s rents. ‘Ambitious’ might be the polite way to describe some of their estimates. Let’s hope those investors do their homework."

Extract From BeesNees Real Estate Blog

The RTA track all rental bonds and in Brisbane CBD and Spring Hill the total has reduced by 700 since its 2007 peak. For example for the full year 2012 the rental pool in postcode 4000 grew by a miserly 3 homes, despite the completion of Adelaide Street’s “Soleil Tower” with 464 apartments.

And there’s no large additions to the rental pool on the horizon. There’s just one big tower under construction in the CBD but it’s a long way from completion. So we’d expect it’s going to be well into 2014 before we see any worthwhile increase in supply.

Despite this we haven’t yet seen any big jumps in rent and 2012 finished with a modest 3% growth in Brisbane’s rents. Our team [at Bees Nees] and other real estate agents are reporting a busy January market and we’re overall optimistic. But renewing tenants are generally not agreeing to big rent increases and rent affordability remains top of mind. Inner city tenants do often move further out to save money. Landlords are still cautious too and they don’t want to risk a vacant home. So it looks most likely that 2013’s rent rises will be steady.

As a sidenote we often see new apartments being sold off-plan with forecast rents that must have some large increases expected on today’s rents. ‘Ambitious’ might be the polite way to describe some of their estimates. Let’s hope those investors do their homework."

Extract From BeesNees Real Estate Blog

Friday, January 25, 2013

Cheaper to buy than rent

There was a story in the AFR yesterday (page 7) with the headline "Cheaper to buy than rent". However, take care with such stories. First, it is based on a report by a mortgage broker, that wants to encourage people to buy and take out loans. Second, it uses average loan sizes and average rents, and so does not compare apples with apples. Third, it does not take into account rates, water fees, body corporate, stamp duty, maintenance or insurance. The article says that it is $800 a year cheaper to buy in Brisbane, but once these additional costs taken into account, it is clearly cheaper to rent than buy even on these misleading figures.

Sunday, January 6, 2013

Renting in Brisbane

Introduction

At this time of year, finding a good apartment or home unit to rent in Brisbane is not easy. In January and February, the demand for apartment rentals is high and many tenants are looking for a place to live.

In the best buildings, the existing tenants do not often leave, and when they do move out, the apartment is often snapped up quickly. For the better buildings, a large percentage of the apartments are occupied by the owner, and so are not rented out. Also, onsite managers often control the rental rolls, and don't often advertise on the usual property websites (as they don't need to do so). Some have their own website. Also, onsite managers may have a relationship with executive relocation services, and the better apartments may be provided to corporate tenants. For the mid-quality buildings, many apartments are furnished and rented on a short term basis, sometimes even overnight. Thus, there may be fewer than expected apartments available for rent.

The largest number of listings are located on RealEstate.com.au, but a number of onsite managers do not use this website. A newer website that has a number of rental listings is the REIQ website. CityApartmentSales is sometimes used by onsite managers to list apartments for rent. Also, try Central Apartments for rentals in Pradella buildings. Domain.com.au is used by real estate agents and private owners, and so may have properties listed that are not listed elsewhere.

At one time, a good specialist website for apartments was www.seqrents.com.au However, it seems that some buildings are not using this site anymore, or are not bothering to update their listing on this site. So, although useful, it is less useful.

You have to find out how each manager advertises his/her vacancy.

Generally, in my opinion, you want to avoid any buildings managed by Oaks, as they focus on short term hotel style rentals.

This website has a list of most city apartment buildings, with useful information and links about them. Also, try this customised search engine. And see www.apartmentreviews.com.au.

You can also look at prior posts on this blog regarding rentals.

Downtown Brisbane:

If you want to live downtown, then I recommend the Admiralty Precinct. This comprises three first-tier buildings (Admiralty One, Admiralty Two and Admiralty Quays), plus River Place and Skyline (second tier). Recently opened just behind these buildings is Meriton's Soleil (in my opinion, lower quality).

Admiralty One is good value, and has some of the largest two bedroom apartments in Brisbane, and is a smaller building. It is direct river front - http://www.admiraltyone.com.au/

Admiralty Two also has good sized apartments, and the building has great facilities. http://www.admiraltytwo.com.au/

Admiralty Quays is newer, and has a great pool, but the apartments are smaller than the two Admiralty buildings listed above, and it is more expensive. http://www.admiraltyquays.com/

Nearby on the river in the city is River Place, and is likely to have availability as this is a large complex. Be careful of Storey Bridge noise. Great views. Great pool.

Soleil has only just opened. It is currently the tallest building in Brisbane. A large building with over 400 apartments, but a large nunber have not been sold. It has short term rentals. This link lists Soleil apartments for rent.

On Alice Street in the city, if you can get an apartment in Quay West, that is fantastic, as it has park and river views. About half the apartments in this building are hotel managed, so it is easy to get short term accommodation in Quay West, but difficult to find an apartment for a long term lease. All apartments are privately owned. Try to rent above level 7 for the better views.

For an inner city downtown building, Metro 21 is one of the better quality buildings. It has only 4 apartments per floor -- and tries to be more upmarket so is better than most downtown buildings that aim at students -- it seems to have better availability, and some of the two bedroom apartments have three bathrooms. The baloneys are large:

http://www.realestate.com.au/realestate/agent/metro+21+brisbane/mlibri

and http://www.metro21apartments.com.au/

M on Mary has recently been taken over by new management, so it will be interesting to see what happens in this building. It was not high on my list previously, but that may change with the new management.

Parklands at Roma Street also has some good apartments.

SouthBank

I recommend Arbour on Grey at SouthBank: http://arbour.com.au/cms/welcome.html

Also, Saville (Mantra) at SouthBank is one of the nicest buildings if you get a river facing apartment. The apartments are level 8 and above. Below level 8 is a hotel. The best thing to do here is call to find out availability. Telephone 07 3305 2559

West End

There is likely to be some availability in some of the riverside West End apartments. These include Waters Edge, Flow, Koko and Left Bank.

Some of the better apartments not on the river road include SL8 and Tempo.

In my view, all of the above West End apartments are too isolated.

Apartments in Suburbs

The suburbs that I recommend, due to location, transport and large number of better quality apartments, are Toowong, St Lucia, Taringa, Indooroopilly and possibly Milton and Hamilton. I don't recommend Chermside.

In Indooroopilly, there has been very little recent construction. Two of the newer, quality buildings Riva and Ciana.

Riva has apartments with great river views. It is a quiet building, with a pool, and is close to the train station and Indooroopilly Shopping Centre. It has good onsite managers, but apartments rarely become available here.

Ciana is a larger new complex, in a central location, with many large apartments. There is a pool and gym, plus a bowls club and restaurant!

One of the newest complex in the Toowong / Taringa area is Fresh. This complex has two pools, a gym and great gardens, and a large number of apartments are owned by super funds and thus are rentals. Try here.

Next door to Fresh is Encore, which is a relatively nice complex, with good pricing (but not as nice as Fresh, and some of the apartments are small). This complex flooded in January 2010.

St Lucia is harder to find quality -- there are few buildings with onsite managers. So you have to try local real estate agents. The best buildings are riverfront, and are expensive.

If you want an apartment complex that feels more suburban, then Parklands at Sherwood is a great choice. Many apartments have park/rural views, and there is a great pool and bbq area.

Nearby is Tennyson Reach, where you can get a large new apartment on the river. This is a new complex, but (apart from river views) not a great location. It was badly flooded. You can rent a high quality apartment at a reasonable price here, if you don't mind the location.

At this time of year, finding a good apartment or home unit to rent in Brisbane is not easy. In January and February, the demand for apartment rentals is high and many tenants are looking for a place to live.

In the best buildings, the existing tenants do not often leave, and when they do move out, the apartment is often snapped up quickly. For the better buildings, a large percentage of the apartments are occupied by the owner, and so are not rented out. Also, onsite managers often control the rental rolls, and don't often advertise on the usual property websites (as they don't need to do so). Some have their own website. Also, onsite managers may have a relationship with executive relocation services, and the better apartments may be provided to corporate tenants. For the mid-quality buildings, many apartments are furnished and rented on a short term basis, sometimes even overnight. Thus, there may be fewer than expected apartments available for rent.

The largest number of listings are located on RealEstate.com.au, but a number of onsite managers do not use this website. A newer website that has a number of rental listings is the REIQ website. CityApartmentSales is sometimes used by onsite managers to list apartments for rent. Also, try Central Apartments for rentals in Pradella buildings. Domain.com.au is used by real estate agents and private owners, and so may have properties listed that are not listed elsewhere.

At one time, a good specialist website for apartments was www.seqrents.com.au However, it seems that some buildings are not using this site anymore, or are not bothering to update their listing on this site. So, although useful, it is less useful.

You have to find out how each manager advertises his/her vacancy.

Generally, in my opinion, you want to avoid any buildings managed by Oaks, as they focus on short term hotel style rentals.

This website has a list of most city apartment buildings, with useful information and links about them. Also, try this customised search engine. And see www.apartmentreviews.com.au.

You can also look at prior posts on this blog regarding rentals.

Downtown Brisbane:

If you want to live downtown, then I recommend the Admiralty Precinct. This comprises three first-tier buildings (Admiralty One, Admiralty Two and Admiralty Quays), plus River Place and Skyline (second tier). Recently opened just behind these buildings is Meriton's Soleil (in my opinion, lower quality).

Admiralty One is good value, and has some of the largest two bedroom apartments in Brisbane, and is a smaller building. It is direct river front - http://www.admiraltyone.com.au/

Admiralty Two also has good sized apartments, and the building has great facilities. http://www.admiraltytwo.com.au/

Admiralty Quays is newer, and has a great pool, but the apartments are smaller than the two Admiralty buildings listed above, and it is more expensive. http://www.admiraltyquays.com/

Nearby on the river in the city is River Place, and is likely to have availability as this is a large complex. Be careful of Storey Bridge noise. Great views. Great pool.

Soleil has only just opened. It is currently the tallest building in Brisbane. A large building with over 400 apartments, but a large nunber have not been sold. It has short term rentals. This link lists Soleil apartments for rent.

On Alice Street in the city, if you can get an apartment in Quay West, that is fantastic, as it has park and river views. About half the apartments in this building are hotel managed, so it is easy to get short term accommodation in Quay West, but difficult to find an apartment for a long term lease. All apartments are privately owned. Try to rent above level 7 for the better views.

For an inner city downtown building, Metro 21 is one of the better quality buildings. It has only 4 apartments per floor -- and tries to be more upmarket so is better than most downtown buildings that aim at students -- it seems to have better availability, and some of the two bedroom apartments have three bathrooms. The baloneys are large:

http://www.realestate.com.au/realestate/agent/metro+21+brisbane/mlibri

and http://www.metro21apartments.com.au/

M on Mary has recently been taken over by new management, so it will be interesting to see what happens in this building. It was not high on my list previously, but that may change with the new management.

Parklands at Roma Street also has some good apartments.

SouthBank

I recommend Arbour on Grey at SouthBank: http://arbour.com.au/cms/welcome.html

Also, Saville (Mantra) at SouthBank is one of the nicest buildings if you get a river facing apartment. The apartments are level 8 and above. Below level 8 is a hotel. The best thing to do here is call to find out availability. Telephone 07 3305 2559

West End

There is likely to be some availability in some of the riverside West End apartments. These include Waters Edge, Flow, Koko and Left Bank.

Some of the better apartments not on the river road include SL8 and Tempo.

In my view, all of the above West End apartments are too isolated.

Apartments in Suburbs

The suburbs that I recommend, due to location, transport and large number of better quality apartments, are Toowong, St Lucia, Taringa, Indooroopilly and possibly Milton and Hamilton. I don't recommend Chermside.

In Indooroopilly, there has been very little recent construction. Two of the newer, quality buildings Riva and Ciana.

Riva has apartments with great river views. It is a quiet building, with a pool, and is close to the train station and Indooroopilly Shopping Centre. It has good onsite managers, but apartments rarely become available here.

Ciana is a larger new complex, in a central location, with many large apartments. There is a pool and gym, plus a bowls club and restaurant!

One of the newest complex in the Toowong / Taringa area is Fresh. This complex has two pools, a gym and great gardens, and a large number of apartments are owned by super funds and thus are rentals. Try here.

Next door to Fresh is Encore, which is a relatively nice complex, with good pricing (but not as nice as Fresh, and some of the apartments are small). This complex flooded in January 2010.

St Lucia is harder to find quality -- there are few buildings with onsite managers. So you have to try local real estate agents. The best buildings are riverfront, and are expensive.

If you want an apartment complex that feels more suburban, then Parklands at Sherwood is a great choice. Many apartments have park/rural views, and there is a great pool and bbq area.

Nearby is Tennyson Reach, where you can get a large new apartment on the river. This is a new complex, but (apart from river views) not a great location. It was badly flooded. You can rent a high quality apartment at a reasonable price here, if you don't mind the location.

Saturday, December 29, 2012

Brisbane Rents

Here is the median Brisbane rent for 2 bedroom apartments, as sourced from the RTA based upon information provided to the RTA when rental bonds are lodged or updated. This does not distinguish between furnished and unfurnished apartments, and does not include lease renewals where the bond amount does not change. This is for the September 2012 quarter.

Post Code 4000 (Brisbane City): $585 per week

Post Code 4005 (New Farm): $530 per week

Post Code 4007 (Hamilton): $420 per week

Post Code 4101 (South Bank/ South Brisbane): $510 per week

Post Code 4066 (Toowong): $395 per week

Post Code 4067 (St Lucia): $420 per week

Post Code 4068 (Indooroopilly/Taringa): $385 per week

There is a lot of good rental information on the RTA website at: Median Rents Quick Finder

Do not use WhatRentMyHome. This "service" is operated by a real estate agency, and the information it provides is inaccurate and out-of-date, and is misleading.

Post Code 4000 (Brisbane City): $585 per week

Post Code 4005 (New Farm): $530 per week

Post Code 4007 (Hamilton): $420 per week

Post Code 4101 (South Bank/ South Brisbane): $510 per week

Post Code 4066 (Toowong): $395 per week

Post Code 4067 (St Lucia): $420 per week

Post Code 4068 (Indooroopilly/Taringa): $385 per week

There is a lot of good rental information on the RTA website at: Median Rents Quick Finder

Do not use WhatRentMyHome. This "service" is operated by a real estate agency, and the information it provides is inaccurate and out-of-date, and is misleading.

Friday, December 21, 2012

Rental Demand in Brisbane

From an REIQ press release:

As we head into the peak demand period for rental properties it is important for tenants to understand the attributes of successful rental applications, according to the Real Estate Institute of Queensland (REIQ). Starting in January, demand for rental properties increases across the State. Demand historically peaks during February and March when, based upon historical Residential Tenancies Authority data, leases for about 40,000 rental properties will be negotiated in just two months.

According to rental listings by REIQ accredited agencies on reiq.com, there are currently about 13,000 properties available for rent across Queensland.

REIQ CEO Anton Kardash said as Queensland’s rental market had been in a state of undersupply for most of 2012, it was more important than ever for prospective tenants to understand the rental process.

“Property managers generally use two equally important criteria when assessing prospective tenants for a rental property. The first is proof of their ability to pay the rent as property managers have a fiduciary duty to the owner, or landlord, to effectively manage the risk of their client’s investment property. Part of the rental process is to assess whether there is sufficient evidence from the prospective tenant that they would be able to meet the rent. The calculation is generally that rent should not exceed 30 per cent of the total income of all tenants named on the lease.”

The second criterion is evidence of ability to care for a property. Proof of this criterion generally can be provided through a rental or home loan history and/or proof of previous living arrangements, references from previous landlords, and/or personal references.

“In times of increased demand, landlords are also reminded that they must advertise their rental property at a fixed amount,” Mr Kardash said.

As we head into the peak demand period for rental properties it is important for tenants to understand the attributes of successful rental applications, according to the Real Estate Institute of Queensland (REIQ). Starting in January, demand for rental properties increases across the State. Demand historically peaks during February and March when, based upon historical Residential Tenancies Authority data, leases for about 40,000 rental properties will be negotiated in just two months.

According to rental listings by REIQ accredited agencies on reiq.com, there are currently about 13,000 properties available for rent across Queensland.

REIQ CEO Anton Kardash said as Queensland’s rental market had been in a state of undersupply for most of 2012, it was more important than ever for prospective tenants to understand the rental process.

“Property managers generally use two equally important criteria when assessing prospective tenants for a rental property. The first is proof of their ability to pay the rent as property managers have a fiduciary duty to the owner, or landlord, to effectively manage the risk of their client’s investment property. Part of the rental process is to assess whether there is sufficient evidence from the prospective tenant that they would be able to meet the rent. The calculation is generally that rent should not exceed 30 per cent of the total income of all tenants named on the lease.”

The second criterion is evidence of ability to care for a property. Proof of this criterion generally can be provided through a rental or home loan history and/or proof of previous living arrangements, references from previous landlords, and/or personal references.

“In times of increased demand, landlords are also reminded that they must advertise their rental property at a fixed amount,” Mr Kardash said.

Monday, September 24, 2012

Self managing landlords

One issue for landlords who self manage is obtaining access to RealEstate.com.au. REA only allows agents to list properties for rent. Domain.com.au allows individual landlords to list a property for rent. In Brisbane, more people seem to use REA than Domain (although I suggest to people looking to rent to search both sites.) Now there is a service that allows self-managing landlords to list on REA. See eezirent.com.au

Saturday, September 22, 2012

Advertised Rents

In today's Courier Mail and on REA, the following new developments had apartments that were advertised for rent:

- Mirvac's Park apartments at Newstead - 2 beds at $700 a week; 3 beds at $1000 a week; 1 bed furnished at $650 a week

- Pradella's Urban Edge at Kelvin Grove - 1 bed from $345 a week; 2 beds from $485 a week

- Metro Property's The Chelsea at Bowen Hills - 1 bed for $405 a week; or $324 via NRAS; 2 bedrooms from $510 a week

Friday, August 31, 2012

Buy or Rent a Brisbane Apartment?

See RP Data's recent and popular "Buy or Rent" report. Details on RP Data blog. The report says that it is better to buy rather than rent an inner city Brisbane apartment. But this also means that landlords are doing well.

"Regional areas of Queensland have a much greater number of suburbs that are currently cheaper to buy than rent compared to Brisbane. Across the state the stronger performance of the regional markets is reflective of the fact that a majority of Queenslander’s live outside of Brisbane and in particular it highlights the strength of the mining and resources regions across the state.

At a Statistical Division level, the most populous region, Brisbane, shows the greatest number of suburbs that are cheaper to buy than rent across most scenarios. This is reflective of the weak capital growth conditions that have been evident across Brisbane and the fact that rents have continued to increase, whilst home values have not."

"Regional areas of Queensland have a much greater number of suburbs that are currently cheaper to buy than rent compared to Brisbane. Across the state the stronger performance of the regional markets is reflective of the fact that a majority of Queenslander’s live outside of Brisbane and in particular it highlights the strength of the mining and resources regions across the state.

At a Statistical Division level, the most populous region, Brisbane, shows the greatest number of suburbs that are cheaper to buy than rent across most scenarios. This is reflective of the weak capital growth conditions that have been evident across Brisbane and the fact that rents have continued to increase, whilst home values have not."

Sunday, August 26, 2012

Buy Real Estate or Buy Apple Stock?

Money Watch: Invest in Apple or buy rental property?

http://usat.ly/PNBhKB

http://usat.ly/PNBhKB

Thursday, August 23, 2012

Rental Crash Coming?

I wonder if a rental crash is coming? From my review of listing portals, there is a build up of property for rent in Brisbane. Some landlords are reducing rents. I am not sure if this is seasonal, or part of a trend. There are less students renting in Brisbane at present, and less consultants doing government work.

If anyone has any evidence on this topic, please let me know.

The economy is not strong in Brisbane. Some government departments are doing forced redundancy programs, where 30% of employees and almost 100% of contractors are being let go. Small business is hurting, with costs increasing and revenue decreasing. My guess is that the actual inflation rate and unemployment rate is higher than being reported.

A reader sent me this via email:

"Enjoy reading your blog, just wondering if you have noticed the huge rise in listed apartments for rent in Brisbane. The price also seems to have fallen, seen 2b2b1c furnished in Bowen Hills/Kelvin Grove for $520. Casino Towers 2b2b1c for $480

Emporium has gone from 2 apartments available 2 weeks ago, to over a dozen. Not sure you keep stats on these things, but would be interesting if you could post them if you do."

If anyone has any evidence on this topic, please let me know.

The economy is not strong in Brisbane. Some government departments are doing forced redundancy programs, where 30% of employees and almost 100% of contractors are being let go. Small business is hurting, with costs increasing and revenue decreasing. My guess is that the actual inflation rate and unemployment rate is higher than being reported.

Tuesday, August 14, 2012

Too Many Rentals Available?

"Investors returning to the property market - and, at times, frustrated vendors unable to sell - have pushed the number of properties advertised for rent to 7057, up from 5732 in July 2011, the latest figures from RP Data reveal. New rental listings are also up, with 3403 new listings compared with 2619 new listings for the same time last year."

See Courier Mail

Thursday, August 2, 2012

No significant improvement: RP Data

Summary of RP Data report:

Capital city home values increased by 0.6% in July after increasing by 1.0% in June

·

Capital city dwelling values increased by 0.6% over

the month of July 2012. Dwelling values are down -0.6% over the first

seven months of 2012 and down -2.4% over the twelve months to July 2012. Home values remain -5.9% below their historic highs

across the combined capitals with falls from the peak ranging from

-11.5% in Brisbane to -2.9% in Sydney.

· Looking at value movements across broad price segments in the market to June 2012, the premium housing market is recording the largest falls (down -3.4% over the year) while the broad ‘middle market’ has been the most resilient with values falling by -2.0% and the most affordable suburbs have recorded value falls of -2.9%.

· Looking at value movements across broad price segments in the market to June 2012, the premium housing market is recording the largest falls (down -3.4% over the year) while the broad ‘middle market’ has been the most resilient with values falling by -2.0% and the most affordable suburbs have recorded value falls of -2.9%.

Sales activity showed a slight improvement in

May however, there has been no significant improvement to date despite

recent interest rate cuts

·

Estimated sales volumes are currently -14% below

the five year average nationally and -13% lower across the combined

capital cities

·

Compared to volumes in May 2011, sales volumes are currently -4% lower nationally and across the capital cities.

Rents continue to improve in certain areas and across specific product types while yields continue to trend upwards

·

Capital city house and rents have increased by 3.0% over the 12 months to July 2012

·

Gross rental yields for houses have improved from

4.0% last July to 4.2% currently and for units they have increased to

4.9% from 4.6% last year.

Vendor discount levels and time on market are trending lower but remain at elevated levels

·

Based on private treaty sales, it took an average

of 60 days to sell a house in the capital cities in June 2012 compared

to 68 days at the same time last year.

·

Vendors are now providing an average discount of

-7.2% from their initial listings price, at the same time last year the

average vendor discount across the capital cities was recorded at -7.6%

The number of homes for sale has been easing however, on an historical basis they remain at quite high levels

·

RP Data is tracking around 296,000 unique houses

and units that are available for sale across Australia; that’s about 9%

higher than at the same time last year.

·

New listings are actually -14% lower than at the same time last year.

·

More than half of the total listings are located in the non capital city markets despite the fact that only 35% of sales take place in these locations.

Economic data flows remain mixed

·

Headline inflation is at 1.2% and core inflation is at 2.0% and trending lower.

·

The Australian economy grew by 4.3% over the first quarter of 2012.

·

The unemployment rate increased from 5.1% in May to 5.2% in June.

·

Consumer confidence for July 2012 showed that

optimism was outweighed by pessimism however, the Index increased by

3.7% over the month.

·

First home buyers accounted for 17.8% of all owner occupier finance commitments over the month.

·

Overall housing finance (ex-refi’s) are up 2.8% over the year while refinance commitments are up 7.5% over the year.

·

Private sector housing credit continues to grow at record low levels of just 5.1% over the 12 months to June 2012.

·

Dwelling approvals were up 10.2% in June 2012 compared to volumes a year earlier.

Wednesday, July 25, 2012

Reader's Comment - Is there a boom?

A reader's view:

There seems to be a dramatic marketing shift going on in Brisbane at present in regard to marketing of apartments and units. The advertising has shifted to promoting the merits of “investing in apartments for rental return” rather than marketing to owner-occupiers. It appears the owner-occupier buyers have all dried up, perhaps they are among the 20,000 workers slated by the State Government for redundancies?

Or are potential owner-occupiers waiting for the release onto the market of thousands of houses and flats currently owned by State and Federal Government that are soon to be placed on the market as a result of the Government push for the private sector to provide (former) public housing by offering the tax-deduction carrot being offered to owners who place rental properties into the NRAS scheme?

One only has to attend the Home Show in Brisbane to see this over-night marketing shift or take a cursory glance at this Saturday’s Courier Mail Property insert. The marketing hype seems to have abandoned the (now) non-existent new owner-occupier buyers and switched to promoting the merits of “investing in units or apartments for rental return” since clearly, the notion of capital gain is now just a pipe dream, at least for the next 5-10 years.

Accompanying press releases and advertisements say how successful the developments are (or going to be – many haven’t even started building) and advertise the numerous sales that have already been made to “investors” for fabulous rental returns. Who is buying these apartments is the question. For example, one in Milton advertises that it has sold $90 million in pre-sales with a vacancy rate of 0.7% and a rental return of 12.4% p.a (Courier Mail Sat 21/7/2012) yet not a sod has been turned on the vacant site. Puzzling indeed.

Others are advertising rental returns of $600-$850 per week around Newstead and Bowen Hills yet a newly completed complex at Bowen Hills, just 2 minutes from the CBD has huge placards visible from the ICB offering rentals at $300 per week. Quite a difference from the advertised rentals of $600-$800 per week available to “investors” less than a kilometre away. Recent data shows around 130 apartments available for lease or sale in the Teneriffe and Newstead area. So while alleged hundreds of units are being “snapped up” by savvy investors cashing in on the “rental boom” (remember the mining boom?) around Brisbane, a number of large unit and/or apartment complexes have been abandoned before they even turned a sod. Puzzling indeed? Yet the marketers claim buyers are scrambling to line up and buy off the plan? More puzzling.

There seems to be a dramatic marketing shift going on in Brisbane at present in regard to marketing of apartments and units. The advertising has shifted to promoting the merits of “investing in apartments for rental return” rather than marketing to owner-occupiers. It appears the owner-occupier buyers have all dried up, perhaps they are among the 20,000 workers slated by the State Government for redundancies?

Or are potential owner-occupiers waiting for the release onto the market of thousands of houses and flats currently owned by State and Federal Government that are soon to be placed on the market as a result of the Government push for the private sector to provide (former) public housing by offering the tax-deduction carrot being offered to owners who place rental properties into the NRAS scheme?

One only has to attend the Home Show in Brisbane to see this over-night marketing shift or take a cursory glance at this Saturday’s Courier Mail Property insert. The marketing hype seems to have abandoned the (now) non-existent new owner-occupier buyers and switched to promoting the merits of “investing in units or apartments for rental return” since clearly, the notion of capital gain is now just a pipe dream, at least for the next 5-10 years.

Accompanying press releases and advertisements say how successful the developments are (or going to be – many haven’t even started building) and advertise the numerous sales that have already been made to “investors” for fabulous rental returns. Who is buying these apartments is the question. For example, one in Milton advertises that it has sold $90 million in pre-sales with a vacancy rate of 0.7% and a rental return of 12.4% p.a (Courier Mail Sat 21/7/2012) yet not a sod has been turned on the vacant site. Puzzling indeed.

Others are advertising rental returns of $600-$850 per week around Newstead and Bowen Hills yet a newly completed complex at Bowen Hills, just 2 minutes from the CBD has huge placards visible from the ICB offering rentals at $300 per week. Quite a difference from the advertised rentals of $600-$800 per week available to “investors” less than a kilometre away. Recent data shows around 130 apartments available for lease or sale in the Teneriffe and Newstead area. So while alleged hundreds of units are being “snapped up” by savvy investors cashing in on the “rental boom” (remember the mining boom?) around Brisbane, a number of large unit and/or apartment complexes have been abandoned before they even turned a sod. Puzzling indeed? Yet the marketers claim buyers are scrambling to line up and buy off the plan? More puzzling.

Sunday, July 22, 2012

REIQ: "Rental demand remains strong"

Extracts from an REIQ Press Release from Friday 20 July 2012:

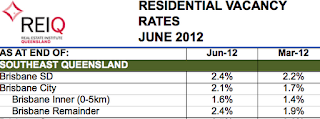

The Queensland rental market remained constricted at the midway point of 2012, according to the latest Real Estate Institute of Queensland’s residential rental vacancy rate survey. The REIQ June vacancy rates - compiled from surveying property managers from REIQ accredited agencies across Queensland - shows demand for rental properties is still exceeding supply in many parts of the State. As at the end of June, rental vacancy rates in many areas remained below 3 per cent, which is considered the equilibrium point of rental supply and demand.

“The first three months of the year are generally the busiest in the Queensland rental cycle so we often see vacancy rates particularly low during this period of time,” REIQ CEO Anton Kardash said. “What our latest survey shows us is that demand for rental property remained strong at the end of June with vacancy rates generally remaining tight. While we are seeing an increase in the number of first home buyers and investors in the sales market, their activity will take some time to flow through to the rental market, which should ease some of this pressure on supply and rents we are now experiencing.”

In Brisbane, the vacancy rate at the end of June was 2.1 per cent, a slight improvement on 1.7 per cent in

March. Inner Brisbane recorded a vacancy rate of 1.6 per cent in June, with property managers from

REIQ accredited agencies reporting some rent increases taking place, especially for houses, due to

stronger demand.

The Queensland rental market remained constricted at the midway point of 2012, according to the latest Real Estate Institute of Queensland’s residential rental vacancy rate survey. The REIQ June vacancy rates - compiled from surveying property managers from REIQ accredited agencies across Queensland - shows demand for rental properties is still exceeding supply in many parts of the State. As at the end of June, rental vacancy rates in many areas remained below 3 per cent, which is considered the equilibrium point of rental supply and demand.

“The first three months of the year are generally the busiest in the Queensland rental cycle so we often see vacancy rates particularly low during this period of time,” REIQ CEO Anton Kardash said. “What our latest survey shows us is that demand for rental property remained strong at the end of June with vacancy rates generally remaining tight. While we are seeing an increase in the number of first home buyers and investors in the sales market, their activity will take some time to flow through to the rental market, which should ease some of this pressure on supply and rents we are now experiencing.”

Saturday, July 21, 2012

Suburbs With Most Rental Properties

Brisbane Suburbs With Highest Proportion of Rental Properties:

- Bowen Hills

- The Valley

- Spring Hill

- South Brisbane

- Milton

- Kelvin Grove

- Kangaroo Point

- West End.

See detailed chart here and article from RP Data.

Monday, July 16, 2012

Brisbane City Census Data

For the past few weeks, I have been looking at the 2011 census data. It is very useful for property investors. In my view, the best place to search is via an address search, and the results are then available in layers, from a few blocks, to suburb, post code area, and so on. You can search here.

For Brisbane City downtown area, in 2011, here is some interesting data (full results here):

For Brisbane City downtown area, in 2011, here is some interesting data (full results here):

- population - 7,888 people

- median age - 29

- Most people are in the 25 to 29 age group (22% of the population)

- 1,526 families

- 32% married

- 37% have University qualifications (compared with 13.5% for Qld or 14.35 for Australia as a whole).

- 4,516 dwellings in total (of which, 98.7% are apartments)

- Average of 2 people per household

- 50.9% of dwellings had 2 bedrooms

- Median weekly household income - $1,828

- 54.5% of dwellings are rented

- Median rent - $530 per week

- 0.8 cars per dwelling

- Ancestry: "The most common ancestries in Brisbane City (State Suburbs) were English 18.0%, Australian 11.3%, Chinese 9.8%, Irish 7.0% and Korean 5.8%."

- Country of birth: "In Brisbane City (State Suburbs), 33.3% of people were born in Australia. The most common countries of birth were Korea, Republic of (South) 6.6%, England 4.4%, China (excludes SARs and Taiwan) 3.9%, Taiwan 3.3% and New Zealand 2.5%."

- 63.5% had both parents born outside of Australia

Friday, June 22, 2012

Byron Bay to New York City

A nice story in the New York Times on Sunday about the founder of PlatinumHD.tv, which is used by some real estate agents to promote property. He has moved from Byron Bay to New York, and just rented a new apartment. The story of his search is here: http://www.nytimes.com/2012/06/17/realestate/roominess-takes-on-new-significance.html

Subscribe to:

Posts (Atom)