I recently visited the display apartments at Rive, Breakfast Creek. (It is being advertised as Breakfast Creek, but it is really in Albion.) I must say that I was a little disappointed. The finishes inside are almost the same as the same developer did for Fresh Apartments in Toowong a number of years ago -- no improvement in finishes, and so Rive Apartments look so last decade.

The views I saw from the apartments were of flat metal roofs of neighbouring industrial areas, and busy roads. The common space felt to me like a second tier suburban office park. The surrounding neighbourhood is not fantastic by any means, unless you want to go to the Breakfast Creek Hotel or Albion Racetrack, which both neighbour this complex.

Prices have dropped (at least from the list price, which I suspect was always an opening gambit) -- a two bedroom has dropped from $610,000 to $570,000; and a three bedroom has dropped from $710,000 to $670,000. An 88 sqm internal two bedroom is listed for sale at $640,000.

Wednesday, August 15, 2012

Tuesday, August 14, 2012

Too Many Rentals Available?

"Investors returning to the property market - and, at times, frustrated vendors unable to sell - have pushed the number of properties advertised for rent to 7057, up from 5732 in July 2011, the latest figures from RP Data reveal. New rental listings are also up, with 3403 new listings compared with 2619 new listings for the same time last year."

See Courier Mail

Holiday Letting Agent Investigation

An interesting article in the AFR on 9 August (page 45) about StayMint (or Mint?) real estate letting agent, and how (it is alleged) they were renting out apartments on a short term basis, but not paying the owners for the rentals. It seems that the government is investigating. This is not a rare problem -- I have heard similar stories in the past about apartment buildings in Brisbane that are rented out on a short term basis, and holiday apartments on the Gold and Sunshine Coasts where the real estate agent or onsite agent pockets the money and tells the owner that the apartment is vacant. This same business manages Skyline in Brisbane.

See "Stay Mint Faces Complaint"

"The Queensland Office of Fair Trading is investigating holiday letting company StayMint, a wholly-owned subsidiary of listed property group Ariadne, following complaints from owners of a Gold Coast apartment block about financial irregularities. Fair Trading officers raided the StayMint office at a Broadbeach apartment complex, Carmel by the Sea, last Thursday and seized financial documents.... The owners said they had discovered people had stayed in their apartment but the stay was not recorded in the monthly statement to the owner, and the rent not paid."

See "Stay Mint Faces Complaint"

"The Queensland Office of Fair Trading is investigating holiday letting company StayMint, a wholly-owned subsidiary of listed property group Ariadne, following complaints from owners of a Gold Coast apartment block about financial irregularities. Fair Trading officers raided the StayMint office at a Broadbeach apartment complex, Carmel by the Sea, last Thursday and seized financial documents.... The owners said they had discovered people had stayed in their apartment but the stay was not recorded in the monthly statement to the owner, and the rent not paid."

Housing Risk

An interesting article by Chris Joye: Housing Risk: It's greater than you think.

"Using some complex statistical methods pioneered by US academics, we estimate that the annual volatility of an individual home with no debt is about 18 per cent. That is similar to the observed risk of the Aussie sharemarket.

But this assumes you have no debt. What happens when you leverage up? The most variable dotted line in the second chart displays the monthly returns yielded by an individual home with 80 per cent gearing. This has a spectacular impact on risk and return. The annual equity volatility of a single property jumps from 18 per cent to north of 38 per cent. On the other hand, returns are also higher.

The key to mitigating risk is diversification. This ideally means a portfolio comprising multiple assets situated in unrelated regions. Hard to achieve, I know. Without diversity, your best way to reduce risk is by using less debt."

See also: 10% lose money when they sell home -- circa 15% after costs

"Using some complex statistical methods pioneered by US academics, we estimate that the annual volatility of an individual home with no debt is about 18 per cent. That is similar to the observed risk of the Aussie sharemarket.

But this assumes you have no debt. What happens when you leverage up? The most variable dotted line in the second chart displays the monthly returns yielded by an individual home with 80 per cent gearing. This has a spectacular impact on risk and return. The annual equity volatility of a single property jumps from 18 per cent to north of 38 per cent. On the other hand, returns are also higher.

The key to mitigating risk is diversification. This ideally means a portfolio comprising multiple assets situated in unrelated regions. Hard to achieve, I know. Without diversity, your best way to reduce risk is by using less debt."

See also: 10% lose money when they sell home -- circa 15% after costs

Ray White's view

This from a Ray White agent's newsletter, about the Brisbane inner-city apartment market:

"Large amounts of buyers enquiring on our properties. I have not seen this level of enquiry since the peaks of 2007. We are expecting price movement in the second half of 2012, on the back of large amounts of property selling."

I guess times must be good. I have emailed a number of agents about apartments listed for sale in Brisbane, and many have not returned my emails. I have inspected a few, and asked to put in an offer, but no reply. I guess there are too many buyers out there, over-running the agents! Or maybe, too many agents have quit the business during the past lean years?

"Large amounts of buyers enquiring on our properties. I have not seen this level of enquiry since the peaks of 2007. We are expecting price movement in the second half of 2012, on the back of large amounts of property selling."

I guess times must be good. I have emailed a number of agents about apartments listed for sale in Brisbane, and many have not returned my emails. I have inspected a few, and asked to put in an offer, but no reply. I guess there are too many buyers out there, over-running the agents! Or maybe, too many agents have quit the business during the past lean years?

Sunday, August 12, 2012

The Plaza South Brisbane

David Devine’s Metro Property Development group has increased its commitment to the inner-Brisbane apartment market, with approval granted for an $80 million project in South Brisbane. The 12-level development, called The Plaza, has been designed by architects Deicke Richards and is due to be built at the corner of Russell and Manning streets on a 2,270-square-metre site and will feature 168 apartments.

Off-the-plan marketing of the project will begin later this month. It will offer a mix of one- and two-bedroom apartments, ranging in price from $330,000 to $575,000. The project will take the value of Metro’s approved apartment developments in Brisbane to more than $400 million.

Metro currently has 1,337 apartments under construction or approved for development in inner Brisbane and a further 950 apartments in the pipeline.

See Property Observer and Prior Post

Comment emailed to me by a reader, after this post was published:

"I came across your blog while searching for a project called The Plaza by developer Metro as you would probably know about. I was basically doing more research on the project as I may be interested in investing in it. Upon researching I found out that Aria would build one called the Vines directly in front of The Plaza which probably would have The Plaza looking to another building rather then the great city views it promises. Bascially from reading through your blog, you have given your opinion on Vines being too expensive...i agree btw."

Off-the-plan marketing of the project will begin later this month. It will offer a mix of one- and two-bedroom apartments, ranging in price from $330,000 to $575,000. The project will take the value of Metro’s approved apartment developments in Brisbane to more than $400 million.

Metro currently has 1,337 apartments under construction or approved for development in inner Brisbane and a further 950 apartments in the pipeline.

See Property Observer and Prior Post

Comment emailed to me by a reader, after this post was published:

"I came across your blog while searching for a project called The Plaza by developer Metro as you would probably know about. I was basically doing more research on the project as I may be interested in investing in it. Upon researching I found out that Aria would build one called the Vines directly in front of The Plaza which probably would have The Plaza looking to another building rather then the great city views it promises. Bascially from reading through your blog, you have given your opinion on Vines being too expensive...i agree btw."

Saturday, August 11, 2012

First Home Buyers Return

From an REIQ press release:

The low interest rate environment and more affordably-priced properties are continuing to attract

Queensland first home buyers into the property market, according to the Real Estate Institute of

Queensland (REIQ).

The latest Australian Bureau of Statistics data found that more than 1,650 properties were financed for Queensland first home buyers in June - an increase of 30 per cent on June last year.

And over the June quarter, according to the Office of State Revenue, more than 5,400 First Home Owner Grants were paid in Queensland compared to 4,000 over the same period in 2011.

The latest Australian Bureau of Statistics data found that more than 1,650 properties were financed for Queensland first home buyers in June - an increase of 30 per cent on June last year.

And over the June quarter, according to the Office of State Revenue, more than 5,400 First Home Owner Grants were paid in Queensland compared to 4,000 over the same period in 2011.

Friday, August 10, 2012

Place Report: Sales of New Apartments in Brisbane

Place Real Estate Agents have issued their report about off-the-plan sales and sales of new apartments in Brisbane in the June 2012 quarter. Here is an extract:

Summary of the June 2012 Quarter

Summary of the June 2012 Quarter

- The June 2012 quarter saw a total of 426 unconditional sales. This is in line with the 448 unconditional sales recorded during the March quarter and is 73% above the 240 sales recorded during same period in 2011.

- A weighted average of $567,664 was recorded during the June 2012 quarter. Again, this is in line with previous periods, presenting a weighted average price only 5% below the June 2011 and resulting in a 12 month rolling weighted average price of $548,806.

- Almost 70% of the unconditional transactions during

- the three months to June 2012 were recorded under $550,000. A total of 11% of the period’s sales were made above $750,000. This is representative of a market that remains price point sensitive.

- Total gross sales, in dollar terms for the June quarter, was approximately $242 million, a figure 40% above the average total gross quarterly sales numbers recorded during the past five years.

- There were three new projects launched during the June 2012 quarter. Hamilton Reach’s new release, Watermarque on the Park, Drew Group’s Precinct and a newly renovated building in Kangaroo Point named Bella Vista.

- Brooklyn on Brookes was the top performing project for the quarter, registering 52 unconditional sales and Madison Heights saw a further 49 unconditional sales taking second position. Following this, Precinct in the Fortitude Valley totalled 38 transactions and Watermarque on the Park registered 34 unconditional sales taking the project to 50% sold on release.

- Inner Brisbane supply tightened during the June 2012 quarter. At the close of the financial year, 1,871 new residential apartments remained for sale. Based upon the sales rate recorded during the June quarter, this translates into a market supply of only 13.5 months.

- Of the apartments which remain for sale, two bedroom supply has increased through the past 12 months to now represent 54% of the available supply. A further 33% are one bedroom apartments whilst only 9% of stock are three bedroom configurations.

Admiralty Precinct Sales

From an email from agent Colin Walsh:

During the first half of 2012, we have handled the sale of 3 apartments and achieved outstanding results for our clients, please see the list of units sold with the sale prices.

SOLD - 105/35 Howard St, Brisbane $532,500

SOLD - 139/501 Queen St, Brisbane $651,000

SOLD - 151/32 Macrossan St, Brisbane $963,000

During the first half of 2012, we have handled the sale of 3 apartments and achieved outstanding results for our clients, please see the list of units sold with the sale prices.

SOLD - 105/35 Howard St, Brisbane $532,500

SOLD - 139/501 Queen St, Brisbane $651,000

SOLD - 151/32 Macrossan St, Brisbane $963,000

Wednesday, August 8, 2012

El Dorado Bust

Although there is still website advertising for PCN's El Dorado Village apartment development at Indooroopilly, it seems like the developer is in receivership, and the undeveloped property is for sale. This is not a surprise. See past posts on this issue. Supposedly over 70 of the 100 apartments had been sold of the plan. Either this was a lie, or the developer just could not make the project work even at PCN's crazy high off-the-plan prices. I hope you are not waiting to move in to your new apartment at El Dorado Village!

I guess it is good-bye, not good buy, El Dorado Village.

I guess it is good-bye, not good buy, El Dorado Village.

Monday, August 6, 2012

Brisbane Airport Proposed Second Runway

What impact will the proposed changes to the Brisbane air traffic patterns have on apartment values in Hamilton?

Sunday, August 5, 2012

Uncertainties, Risks and Body Corporate Fees

I feel that now is probably a good time to buy an apartment in Brisbane. Prices are down, and there are many good apartments for sale. However, there are uncertainties that are holding me back:

Article in AFR, 7 August, P38: Newman at a get together of banks and bizo’s was playing pretend Reserve Bank Chief and instructing banks to start lending. Banks won’t (as we all know), denying they should take risks just for Newman et al. Last para of article states : At a meeting of people from the big four banks recently, one person from one of the big four proclaimed “We’re not lending anything into Northern Australia. Northern Australia begins at Nundah in Brisbane.”

- What will happen if the mining boom comes to an end?

- Will Newman's retrenchment of 20% of the public service kill any chance of growth for the next 3 years?

- Will Newman increase land tax rates and lower land tax threasolds in Queensland?

- What will Newman and the Attorney-General do in relation to the complex issues regarding lot adjustments (that impact the percentage of body corporate fees an individual unit owner will pay)? If I buy now, will the unit entitlements be adjusted up in the near future so that my body corporate fees will increase? Will there be costly legal action between the body corporate and various interest groups in the buildings. See here and here for example. Changes to this are a priority for the government it seems, to reward penthouse owners for voting for the Liberal party.

So, for the time being, there is too much uncertainty and risk to buy an apartment (or an investment property) in Brisbane or Queensland.

Regardless, body corporate fees and council rates are becoming prohibitively high, and make investing in apartments less attractive.

I looked at an older apartment on the river recently. It has been on the market for more than 6 months. It is a 2 bedroom (with a small second bedroom), with river views. The facilities are moderate -- no doorman, onsite manager, reception desk or the like. The list price has come down, and is now $455,000. But the body corporate fees are $8,830 a year, and council rates are $2,000 a year. So more than $10,000 a year in these expenses. The rent for this apartment would be about $400 a week, or about $365 a week after real estate agent's fees. So that is 30 weeks, or more than half a year's rent, just to cover body corporate levies and rates! Clearly, this is not a good investment, even if the price drops another $100,000.

Post-script -- comment from a reader after this post was published:

Your sentiments re purchasing a unit or apartment in Brisbane reflect my own also, very valid points.

Another is upcoming or planned or approved “future” capital works such as painting, under-pinning, structural repairs, landscaping, tree removals and the like. At a number of units I have looked at, the agents got very cagy when put the question. Pressing one very hard got I wind of a complete paint job coming up within 2 years, approx $250,000k across 80 units, and unit titles re-appropriation may also make some owners rather unhappy as well. Ouch! Another had $30,000K in quotes not yet voted on (but very necessary since drains were becoming repeatedly blocked by roots) for tree removal. Ouch! Many units 10 years and over now need a lot of work, much of which has been delayed or put back but it’s coming. New buyers beware.Post-script -- comment from a reader after this post was published:

Your sentiments re purchasing a unit or apartment in Brisbane reflect my own also, very valid points.

Article in AFR, 7 August, P38: Newman at a get together of banks and bizo’s was playing pretend Reserve Bank Chief and instructing banks to start lending. Banks won’t (as we all know), denying they should take risks just for Newman et al. Last para of article states : At a meeting of people from the big four banks recently, one person from one of the big four proclaimed “We’re not lending anything into Northern Australia. Northern Australia begins at Nundah in Brisbane.”

Saturday, August 4, 2012

South Brisbane Apartments

There are two large apartment buildings currently in presales in South Brisbane. One is Metro's The Plaza development. The other is Pradella's Canvas.

The Plaza is 12 levels of one and two bedroom apartments, priced up to $575,000. It is on the corner of Russell and Manning Streets.

Canvas is located on Boundary Street, and has 141 one and two bedroom apartments. The one bedrooms start at $346,000 and the two bedrooms start at $538,000. The one bedrooms shown on the website are small -- 44 sqm internal plus a 10 sqm balcony. This is about the size of a hotel suite. The two bedrooms range in size (internally) from 76 to 82 sqm. They are lower quality apartments, with the air conditioning compressor on the balcony for example.

To get a good idea of how small these apartments will be, have a look at a prior Pradella project in South Brisbane -- Allegro. Some details about Allegro are here, and video here. Go and have a look before you buy off the plan, so you can see what a small apartment is like. Apt 96 is for sale for $410,000, and it has two bedrooms. Apt 72 is two bedrooms with city views, listed at $420,000.

Or you can buy a top quality 2 bedroom apartment today in Saville South Bank, for $500,000 to $540,000. Saville is in a better location than The Plaza and Canvas, and is a much higher quality build than Allegro. Apt 1115 is a two bedroom listed for sale for $529,000, and it is 85 sqm internal with a 10 sqm balcony. I could be wrong, but this seems to me to be a much better buy than a smaller, lower quality apartment in Canvas which is more expensive, and has the added significant risk factor of buying off-the-plan.

The Plaza is 12 levels of one and two bedroom apartments, priced up to $575,000. It is on the corner of Russell and Manning Streets.

Canvas is located on Boundary Street, and has 141 one and two bedroom apartments. The one bedrooms start at $346,000 and the two bedrooms start at $538,000. The one bedrooms shown on the website are small -- 44 sqm internal plus a 10 sqm balcony. This is about the size of a hotel suite. The two bedrooms range in size (internally) from 76 to 82 sqm. They are lower quality apartments, with the air conditioning compressor on the balcony for example.

To get a good idea of how small these apartments will be, have a look at a prior Pradella project in South Brisbane -- Allegro. Some details about Allegro are here, and video here. Go and have a look before you buy off the plan, so you can see what a small apartment is like. Apt 96 is for sale for $410,000, and it has two bedrooms. Apt 72 is two bedrooms with city views, listed at $420,000.

Or you can buy a top quality 2 bedroom apartment today in Saville South Bank, for $500,000 to $540,000. Saville is in a better location than The Plaza and Canvas, and is a much higher quality build than Allegro. Apt 1115 is a two bedroom listed for sale for $529,000, and it is 85 sqm internal with a 10 sqm balcony. I could be wrong, but this seems to me to be a much better buy than a smaller, lower quality apartment in Canvas which is more expensive, and has the added significant risk factor of buying off-the-plan.

Friday, August 3, 2012

River Place - Recent Sales

Recent sales for River Place, 82 Boundary Street, on the river in Brisbane.

- Apt 142, 2 bed, 2 bath, sold in May fully furnished for $563,000

- Apt 79, 2 bed, 2 bath, sold in May for $618,000

- Apt 98, 1 bed, 1 bath, sold in March for $402,000

- Apt 59, 2 bed, 2 bath, sold in March for $539,500

- Apt 319, 4 bed, 2 bath, sold in March for $1,815,000

Oaks Aurora Towers - Recent Sales

Recent sales in Oaks Aurora Towers, an apartment building at 420 Queen Street that is managed by the onsite manager as a short term serviced apartment complex.

- Apt 316, 2 bedrooms, 2 bathrooms, sold in June for $582,500

- Apt 84, 2 bedrooms, sold in May for $512,500

- Apt 439, 2 bedrooms, 1 bathroom, sold in May for $500,000

- Apt 289, 2 bedrooms, 1 bathroom (no car), sold in May for $420,000

- Apt 356, 2 bedrooms, 2 bathroom, sold in April for $600,000

- Apt 514, 2 bedrooms, 2 bathroom, sold in March for $605,000

- Apt 368, 2 bedrooms, 1 bathroom, 1 car, sold in March for $428,000

Highest priced sale this year:

Apartments or Houses?

"Nationally, 58% of flats, units and apartments are owned by investors. That is quite an amazing statistic, especially when you compare that with detached houses where only 21% are investor owned.

Across the capital cities the proportions are even higher. Darwin tops the list with 70.6% of all units being rented followed by Brisbane where 70.2% of all units are rented."

See RP Data Blog

See RP Data Blog

Barefoot Investors Advice re Property

"My

opinion on traditional Aussie housing hasn't changed one iota: I still

firmly believe that most investment properties bought today are a trap.

Their prices are too high and their returns too low to justify the

dangerous debt burden needed to 'get in the property game'.

That

fact is backed up by the Australian Tax Office's latest figures, which

show that, despite collecting $28 billion in rents last year,

Australia's landlords still reported a $4.8 billion loss. Less than four

in ten property investors made any money last year."

Source: Barefoot Investor

Thursday, August 2, 2012

South Brisbane apartment

Proposed apartment building by Aria at 77 Grey Street in South Brisbane. Proposed to be 18 stories.

36 two bedroom apartments & 84 one bedroom apartments (for a total of 120 apartments), but only 106 car parks including visitor car parking.

Many of the apartments will have a nice view of the wall of the museum, or the very busy Grey St/Melbourne St intersection and busway.

36 two bedroom apartments & 84 one bedroom apartments (for a total of 120 apartments), but only 106 car parks including visitor car parking.

Many of the apartments will have a nice view of the wall of the museum, or the very busy Grey St/Melbourne St intersection and busway.

Queen Street Proposal

Proposed building by Grocon for the failed Trilogy site in Queen Street. Aurora Towers on the far left. The proposed building is not riverfront, but on the far side of the road from the river. Newspaper reports say that national law firm Freehills has agreed to rent the top 3 floors. I wonder if this building will get off the ground, or be like Trilogy Tower and never be built?

Gold Coast Prices Have Further to Fall

THE Gold Coast housing market is about six months off the bottom, according to analysts. Two separate housing indexes showed a rise in capital city house values in June, indicating the slump in house prices appears to have bottomed and the market is about to improve again, underpinned by recent interest rate cuts.

But the Gold Coast recorded one of the largest falls of any region in the country and still has some way to go, according to RP Data research director Tim Lawless. "I don't think it has reached the bottom yet but the Gold Coast is probably approaching that mark and in the next six months should bottom out and start turning around," he said.

Story Here

But the Gold Coast recorded one of the largest falls of any region in the country and still has some way to go, according to RP Data research director Tim Lawless. "I don't think it has reached the bottom yet but the Gold Coast is probably approaching that mark and in the next six months should bottom out and start turning around," he said.

Story Here

111 Eagle St Opening

111 Eagle Street opened last night. It is not an apartment building, but it is next door to Riparian apartments. Photo here.

No significant improvement: RP Data

Summary of RP Data report:

Capital city home values increased by 0.6% in July after increasing by 1.0% in June

·

Capital city dwelling values increased by 0.6% over

the month of July 2012. Dwelling values are down -0.6% over the first

seven months of 2012 and down -2.4% over the twelve months to July 2012. Home values remain -5.9% below their historic highs

across the combined capitals with falls from the peak ranging from

-11.5% in Brisbane to -2.9% in Sydney.

· Looking at value movements across broad price segments in the market to June 2012, the premium housing market is recording the largest falls (down -3.4% over the year) while the broad ‘middle market’ has been the most resilient with values falling by -2.0% and the most affordable suburbs have recorded value falls of -2.9%.

· Looking at value movements across broad price segments in the market to June 2012, the premium housing market is recording the largest falls (down -3.4% over the year) while the broad ‘middle market’ has been the most resilient with values falling by -2.0% and the most affordable suburbs have recorded value falls of -2.9%.

Sales activity showed a slight improvement in

May however, there has been no significant improvement to date despite

recent interest rate cuts

·

Estimated sales volumes are currently -14% below

the five year average nationally and -13% lower across the combined

capital cities

·

Compared to volumes in May 2011, sales volumes are currently -4% lower nationally and across the capital cities.

Rents continue to improve in certain areas and across specific product types while yields continue to trend upwards

·

Capital city house and rents have increased by 3.0% over the 12 months to July 2012

·

Gross rental yields for houses have improved from

4.0% last July to 4.2% currently and for units they have increased to

4.9% from 4.6% last year.

Vendor discount levels and time on market are trending lower but remain at elevated levels

·

Based on private treaty sales, it took an average

of 60 days to sell a house in the capital cities in June 2012 compared

to 68 days at the same time last year.

·

Vendors are now providing an average discount of

-7.2% from their initial listings price, at the same time last year the

average vendor discount across the capital cities was recorded at -7.6%

The number of homes for sale has been easing however, on an historical basis they remain at quite high levels

·

RP Data is tracking around 296,000 unique houses

and units that are available for sale across Australia; that’s about 9%

higher than at the same time last year.

·

New listings are actually -14% lower than at the same time last year.

·

More than half of the total listings are located in the non capital city markets despite the fact that only 35% of sales take place in these locations.

Economic data flows remain mixed

·

Headline inflation is at 1.2% and core inflation is at 2.0% and trending lower.

·

The Australian economy grew by 4.3% over the first quarter of 2012.

·

The unemployment rate increased from 5.1% in May to 5.2% in June.

·

Consumer confidence for July 2012 showed that

optimism was outweighed by pessimism however, the Index increased by

3.7% over the month.

·

First home buyers accounted for 17.8% of all owner occupier finance commitments over the month.

·

Overall housing finance (ex-refi’s) are up 2.8% over the year while refinance commitments are up 7.5% over the year.

·

Private sector housing credit continues to grow at record low levels of just 5.1% over the 12 months to June 2012.

·

Dwelling approvals were up 10.2% in June 2012 compared to volumes a year earlier.

Wednesday, August 1, 2012

Brisbane Apartments are Worst Performing Market: RP Data Statistics

Dwelling values across capital cities recorded a second month of capital gains in July with dwelling values up by 0.6% over the month following a 1.0% rise in June. The RP Data-Rismark Home Value indices posted a second successive rise in capital city dwelling values over the month of July. Across the combined capital cities, dwelling values rose by 0.6 per cent over the month with the rises being relatively consistently over the first three weeks of July followed by a -0.2 per cent fall over the final week of the month. Over the three months to the end of July, capital city dwellings have posted an increase of 0.2 per cent.

See RP Data July Release

Brisbane apartment prices:

July 2012 - down 2%

Quarter - up 0.3%

Year to Date - down 3.9%

Year on Year - down 5%

Median price based on settled sales of Brisbane apartments over the quarter - $366,000.

The Brisbane apartment market is the worst performing capital city apartment market in Australia this year.

Below is a chart for dwellings, which includes both houses and apartments:

See RP Data July Release

Brisbane apartment prices:

July 2012 - down 2%

Quarter - up 0.3%

Year to Date - down 3.9%

Year on Year - down 5%

Median price based on settled sales of Brisbane apartments over the quarter - $366,000.

The Brisbane apartment market is the worst performing capital city apartment market in Australia this year.

Below is a chart for dwellings, which includes both houses and apartments:

Brisbane Downtown Ghost town

An interesting article from The Telegraph that says that the Brisbane downtown is a ghost town. But despite this, car parks are charging $72 to park for 3 hours.

Monday, July 30, 2012

Value Accumulation by major Queensland regions

Across Queensland, 9.6 percent of homes are worth less than or equal to their initial purchase price while

36.6 percent of homes are worth more than double their initial purchase price. At the end of the

corresponding quarter in 2011, 3.7 percent of homes were worth less than or equal to their initial purchase

price and 40.3 percent of homes were worth more than double. These results highlight the growing impact

of the continued underperformance of the Queensland housing market.

Source: RP Data

Source: RP Data

Sunday, July 29, 2012

Profits and Losses on Actual Sales Data

From a report from RP Data, that shows a number of people made losses when sell property -- it is not true to say "as safe as houses" if you buy badly or at the wrong time or hold for a short period:

As a special feature in this report we examine the level of gross profit or loss based on residential dwellings that sold during the March quarter of 2012. The results are shown in the graphs below across all sales and also divided between homes that were purchased pre and post GFC (before or after January 1, 2008).

Of those owners that had purchased their home prior to the financial crisis (for the purposes of analysis we have used the date of January 1, 2008), a lower 7.2 percent had sold their home at a loss. A much greater 42.3 percent of these vendors sold their home at price which was at least double the previous purchase price.

Capital gains were much weaker for those vendors who had purchased their home in 2008 or thereafter. A larger proportion of these vendors recorded a loss on their sale, with 27.5 percent of dwellings sold recording a sale price lower than the initial purchase price. On the other hand, only 7.5 percent recorded a capital gain of more than 50 percent compared to the original purchase price. These results reflect the significantly weaker housing market conditions since 2008 and the benefits of a long term hold when it comes to turning a profit on residential property.

As a special feature in this report we examine the level of gross profit or loss based on residential dwellings that sold during the March quarter of 2012. The results are shown in the graphs below across all sales and also divided between homes that were purchased pre and post GFC (before or after January 1, 2008).

Of those owners that had purchased their home prior to the financial crisis (for the purposes of analysis we have used the date of January 1, 2008), a lower 7.2 percent had sold their home at a loss. A much greater 42.3 percent of these vendors sold their home at price which was at least double the previous purchase price.

Capital gains were much weaker for those vendors who had purchased their home in 2008 or thereafter. A larger proportion of these vendors recorded a loss on their sale, with 27.5 percent of dwellings sold recording a sale price lower than the initial purchase price. On the other hand, only 7.5 percent recorded a capital gain of more than 50 percent compared to the original purchase price. These results reflect the significantly weaker housing market conditions since 2008 and the benefits of a long term hold when it comes to turning a profit on residential property.

Thursday, July 26, 2012

Pets - from a reader

We’re big fans of your blog over at Insurancequotes.org and wanted to share with you one of our new favorite posts, about pet and home renting, called, 8 Risks of Renting with a Pet. Your readers might also be interested in taking a look, and we’d appreciate it if you have the space to mention or feature it alongside your regular posts.

Wednesday, July 25, 2012

Comparing Different Apartments

This note came from a real estate agent's newsletter (HS Brisbane Property):

Be informed!!

This is, funnily, exactly what's

happening in the Brisbane CBD with some reported and advertised property sales'

prices - they are both CBD apartments, they both have 2bedrooms, so should they

sell for the same price? Absolutely not. They may have different numbers of

bathrooms, different views, different numbers of car spaces ... and more.

So when I

read 'Highest achieved price for 2bed unit in building 'XYZ' in 3

years!', I think "Hmmm ... could be that they're comparing apples

with tomatoes!".

Without going into details it's

interesting to note:

à An additional car space

will add approx. $60,000 (or in some cases more) to the price of an apartment.

However, a tandem car space will not achieve the same price as a single

carspace. Example: 2bed unit with 2 car spaces will sell for approx. $60,000

more than one with only 1 carspace.

à Views mean $$$

... sometimes. Apart from the direct riverfront views of some buildings and the

eagle-soaring views from the top of 74-floor Soleil or 69-floor Aurora

à Apartment size and no. bathrooms. For a 2bed apartment, 2bathrooms would normally achieve higher prices

than 1bathroom, but this may also depend on other factors such as the overall

apartment size. A larger, well-designed apartment would also be expected to

sell for more than a smaller type. Compare the apartment sizes and floorplans.

Back to our advertised highest

price. Always ask yourself : what types of

apartment is this being compared to? What size, floorplan, level,

outlook, no. bathrooms and carspaces, and what does it include?

It may still be the highest price in

years, but it may be like comparing apples and tomatoes .. they are very

different.

Reader's Comment - Is there a boom?

A reader's view:

There seems to be a dramatic marketing shift going on in Brisbane at present in regard to marketing of apartments and units. The advertising has shifted to promoting the merits of “investing in apartments for rental return” rather than marketing to owner-occupiers. It appears the owner-occupier buyers have all dried up, perhaps they are among the 20,000 workers slated by the State Government for redundancies?

Or are potential owner-occupiers waiting for the release onto the market of thousands of houses and flats currently owned by State and Federal Government that are soon to be placed on the market as a result of the Government push for the private sector to provide (former) public housing by offering the tax-deduction carrot being offered to owners who place rental properties into the NRAS scheme?

One only has to attend the Home Show in Brisbane to see this over-night marketing shift or take a cursory glance at this Saturday’s Courier Mail Property insert. The marketing hype seems to have abandoned the (now) non-existent new owner-occupier buyers and switched to promoting the merits of “investing in units or apartments for rental return” since clearly, the notion of capital gain is now just a pipe dream, at least for the next 5-10 years.

Accompanying press releases and advertisements say how successful the developments are (or going to be – many haven’t even started building) and advertise the numerous sales that have already been made to “investors” for fabulous rental returns. Who is buying these apartments is the question. For example, one in Milton advertises that it has sold $90 million in pre-sales with a vacancy rate of 0.7% and a rental return of 12.4% p.a (Courier Mail Sat 21/7/2012) yet not a sod has been turned on the vacant site. Puzzling indeed.

Others are advertising rental returns of $600-$850 per week around Newstead and Bowen Hills yet a newly completed complex at Bowen Hills, just 2 minutes from the CBD has huge placards visible from the ICB offering rentals at $300 per week. Quite a difference from the advertised rentals of $600-$800 per week available to “investors” less than a kilometre away. Recent data shows around 130 apartments available for lease or sale in the Teneriffe and Newstead area. So while alleged hundreds of units are being “snapped up” by savvy investors cashing in on the “rental boom” (remember the mining boom?) around Brisbane, a number of large unit and/or apartment complexes have been abandoned before they even turned a sod. Puzzling indeed? Yet the marketers claim buyers are scrambling to line up and buy off the plan? More puzzling.

There seems to be a dramatic marketing shift going on in Brisbane at present in regard to marketing of apartments and units. The advertising has shifted to promoting the merits of “investing in apartments for rental return” rather than marketing to owner-occupiers. It appears the owner-occupier buyers have all dried up, perhaps they are among the 20,000 workers slated by the State Government for redundancies?

Or are potential owner-occupiers waiting for the release onto the market of thousands of houses and flats currently owned by State and Federal Government that are soon to be placed on the market as a result of the Government push for the private sector to provide (former) public housing by offering the tax-deduction carrot being offered to owners who place rental properties into the NRAS scheme?

One only has to attend the Home Show in Brisbane to see this over-night marketing shift or take a cursory glance at this Saturday’s Courier Mail Property insert. The marketing hype seems to have abandoned the (now) non-existent new owner-occupier buyers and switched to promoting the merits of “investing in units or apartments for rental return” since clearly, the notion of capital gain is now just a pipe dream, at least for the next 5-10 years.

Accompanying press releases and advertisements say how successful the developments are (or going to be – many haven’t even started building) and advertise the numerous sales that have already been made to “investors” for fabulous rental returns. Who is buying these apartments is the question. For example, one in Milton advertises that it has sold $90 million in pre-sales with a vacancy rate of 0.7% and a rental return of 12.4% p.a (Courier Mail Sat 21/7/2012) yet not a sod has been turned on the vacant site. Puzzling indeed.

Others are advertising rental returns of $600-$850 per week around Newstead and Bowen Hills yet a newly completed complex at Bowen Hills, just 2 minutes from the CBD has huge placards visible from the ICB offering rentals at $300 per week. Quite a difference from the advertised rentals of $600-$800 per week available to “investors” less than a kilometre away. Recent data shows around 130 apartments available for lease or sale in the Teneriffe and Newstead area. So while alleged hundreds of units are being “snapped up” by savvy investors cashing in on the “rental boom” (remember the mining boom?) around Brisbane, a number of large unit and/or apartment complexes have been abandoned before they even turned a sod. Puzzling indeed? Yet the marketers claim buyers are scrambling to line up and buy off the plan? More puzzling.

Tuesday, July 24, 2012

RBA's view

The RBA governor said future economic shocks that would hurt Australia could happen in a number of ways, such as a severe economic slowdown in China and a collapse in dwelling prices.

"The ingredients we would look for as signalling an imminent crash seem, if anything, less in evidence now than five years ago," he said.

"By the same token there are things we can do to improve our prospects or, if you will, to make a bit of our own future luck," he said. "Some of the adjustments we have been seeing, as awkward as they might seem, are actually strengthening resilience to possible future shocks. Higher more normal rates of household saving, a more sober attitude towards debt, a re-orientation of banks funding, and a period of dwelling prices not moving much come into this category," Mr Stevens said.

Read more: http://www.news.com.au/business/we-should-build-on-our-luck-rbas-stevens/story-e6frfm1i-1226433865255#ixzz21XBd1kh4

"The ingredients we would look for as signalling an imminent crash seem, if anything, less in evidence now than five years ago," he said.

"By the same token there are things we can do to improve our prospects or, if you will, to make a bit of our own future luck," he said. "Some of the adjustments we have been seeing, as awkward as they might seem, are actually strengthening resilience to possible future shocks. Higher more normal rates of household saving, a more sober attitude towards debt, a re-orientation of banks funding, and a period of dwelling prices not moving much come into this category," Mr Stevens said.

Read more: http://www.news.com.au/business/we-should-build-on-our-luck-rbas-stevens/story-e6frfm1i-1226433865255#ixzz21XBd1kh4

Oversupply of dwellings in Australia

"The 2011 Census revealed Australia had 7.8 million households, 900,000 lower than the NHSC’s figure, with population also growing by 300,000 less than previously estimated. These figures have come as such a shock that the NHSC chairman has reported that an undersupply could be incorrect. In fact, Morgan Stanley researchers have found that the current 228,000 dwelling undersupply has now become an oversupply of 341,000, a huge turnaround."

See: Don't be dudded by housing data

See: Don't be dudded by housing data

Sunday, July 22, 2012

REIQ: "Rental demand remains strong"

Extracts from an REIQ Press Release from Friday 20 July 2012:

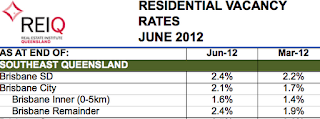

The Queensland rental market remained constricted at the midway point of 2012, according to the latest Real Estate Institute of Queensland’s residential rental vacancy rate survey. The REIQ June vacancy rates - compiled from surveying property managers from REIQ accredited agencies across Queensland - shows demand for rental properties is still exceeding supply in many parts of the State. As at the end of June, rental vacancy rates in many areas remained below 3 per cent, which is considered the equilibrium point of rental supply and demand.

“The first three months of the year are generally the busiest in the Queensland rental cycle so we often see vacancy rates particularly low during this period of time,” REIQ CEO Anton Kardash said. “What our latest survey shows us is that demand for rental property remained strong at the end of June with vacancy rates generally remaining tight. While we are seeing an increase in the number of first home buyers and investors in the sales market, their activity will take some time to flow through to the rental market, which should ease some of this pressure on supply and rents we are now experiencing.”

In Brisbane, the vacancy rate at the end of June was 2.1 per cent, a slight improvement on 1.7 per cent in

March. Inner Brisbane recorded a vacancy rate of 1.6 per cent in June, with property managers from

REIQ accredited agencies reporting some rent increases taking place, especially for houses, due to

stronger demand.

The Queensland rental market remained constricted at the midway point of 2012, according to the latest Real Estate Institute of Queensland’s residential rental vacancy rate survey. The REIQ June vacancy rates - compiled from surveying property managers from REIQ accredited agencies across Queensland - shows demand for rental properties is still exceeding supply in many parts of the State. As at the end of June, rental vacancy rates in many areas remained below 3 per cent, which is considered the equilibrium point of rental supply and demand.

“The first three months of the year are generally the busiest in the Queensland rental cycle so we often see vacancy rates particularly low during this period of time,” REIQ CEO Anton Kardash said. “What our latest survey shows us is that demand for rental property remained strong at the end of June with vacancy rates generally remaining tight. While we are seeing an increase in the number of first home buyers and investors in the sales market, their activity will take some time to flow through to the rental market, which should ease some of this pressure on supply and rents we are now experiencing.”

Hilton Gold Coast - Huge Number of Crashed Contracts

A number of years ago, I "awarded" the Hilton Residents on the Gold Coast as one of the worst apartment investments in SE Queensland. See prior posts. A number of years ago, there were many press releases about how successful the development was, and how many sales were made off the plan to investors. I could not figure out who was buying these apartments, or why, as this development was not in a prime location, and surrounded by vacant shops and topless bars.

Now it has come to light that many of the investors were from outside Australia, and more than 100 purchasers have failed to settle (or about 25% of buyers). Values have dropped dramatically, with apartments sold off the plan for $1.4M now valued at about $800,000. (This book would have been helpful to these buyers.)

A number of purchasers who did settle have not put their apartments into the onsite rental pool with Hilton, and offsite agents are making under the name "H Residences". This shows that rental returns are likely to be poor.

Many apartments on the Gold and Sunshine Coasts have decreased in value since 2008. I know of a recent Juniper beachfront apartment that was sold off the plan for over $1.4M, that remains unsold today at $800,000.

See also this article.

Now it has come to light that many of the investors were from outside Australia, and more than 100 purchasers have failed to settle (or about 25% of buyers). Values have dropped dramatically, with apartments sold off the plan for $1.4M now valued at about $800,000. (This book would have been helpful to these buyers.)

A number of purchasers who did settle have not put their apartments into the onsite rental pool with Hilton, and offsite agents are making under the name "H Residences". This shows that rental returns are likely to be poor.

Many apartments on the Gold and Sunshine Coasts have decreased in value since 2008. I know of a recent Juniper beachfront apartment that was sold off the plan for over $1.4M, that remains unsold today at $800,000.

See also this article.

Shrinking Apartment Sizes

In Brisbane, apartment sizes are shrinking. Newer apartments are smaller than older apartments. Many two bedroom apartments are now less than 85 sqm in total size (including balcony), compared with about 100 sqm five years ago, or 120 sqm ten years ago.

For example, DoubleOne3, a Devine project, has two bedroom, two bathroom apartments that have a total size of 74 sqm including balcony. The "Superior" two bedrooms, on the corners of the building are 105 sqm in total size.

As another example, the size of two bedroom apartments in Mirvac's Park development at Newstead range from 96sqm to 112 sqm. Mirvac builds larger than most developers, to a higher quality. But compare Mirvac's Quay West development in Brisbane from more than 10 years ago. There, the two bedroom apartments were 126 sqm. In Mirvac's Arbour on Grey, from about ten years ago, most of the the two bedrooms were around 109 sqm.

In NYC, the size of new rental apartments is also decreasing, but the size of owner-occupied condos is increasing. See NY Times. I think that a similar distinction will arise in Brisbane, where two bedroom apartments less than 95 sqm in total size will be relegated as investor only product. Moreover, care should be taken when comparing apartments. Often the smaller newer apartments are more expensive than the older, larger apartments.

For example, DoubleOne3, a Devine project, has two bedroom, two bathroom apartments that have a total size of 74 sqm including balcony. The "Superior" two bedrooms, on the corners of the building are 105 sqm in total size.

As another example, the size of two bedroom apartments in Mirvac's Park development at Newstead range from 96sqm to 112 sqm. Mirvac builds larger than most developers, to a higher quality. But compare Mirvac's Quay West development in Brisbane from more than 10 years ago. There, the two bedroom apartments were 126 sqm. In Mirvac's Arbour on Grey, from about ten years ago, most of the the two bedrooms were around 109 sqm.

In NYC, the size of new rental apartments is also decreasing, but the size of owner-occupied condos is increasing. See NY Times. I think that a similar distinction will arise in Brisbane, where two bedroom apartments less than 95 sqm in total size will be relegated as investor only product. Moreover, care should be taken when comparing apartments. Often the smaller newer apartments are more expensive than the older, larger apartments.

Subscribe to:

Posts (Atom)