Thursday, July 26, 2012

Pets - from a reader

We’re big fans of your blog over at Insurancequotes.org and wanted to share with you one of our new favorite posts, about pet and home renting, called, 8 Risks of Renting with a Pet. Your readers might also be interested in taking a look, and we’d appreciate it if you have the space to mention or feature it alongside your regular posts.

Wednesday, July 25, 2012

Comparing Different Apartments

This note came from a real estate agent's newsletter (HS Brisbane Property):

Be informed!!

This is, funnily, exactly what's

happening in the Brisbane CBD with some reported and advertised property sales'

prices - they are both CBD apartments, they both have 2bedrooms, so should they

sell for the same price? Absolutely not. They may have different numbers of

bathrooms, different views, different numbers of car spaces ... and more.

So when I

read 'Highest achieved price for 2bed unit in building 'XYZ' in 3

years!', I think "Hmmm ... could be that they're comparing apples

with tomatoes!".

Without going into details it's

interesting to note:

à An additional car space

will add approx. $60,000 (or in some cases more) to the price of an apartment.

However, a tandem car space will not achieve the same price as a single

carspace. Example: 2bed unit with 2 car spaces will sell for approx. $60,000

more than one with only 1 carspace.

à Views mean $$$

... sometimes. Apart from the direct riverfront views of some buildings and the

eagle-soaring views from the top of 74-floor Soleil or 69-floor Aurora

à Apartment size and no. bathrooms. For a 2bed apartment, 2bathrooms would normally achieve higher prices

than 1bathroom, but this may also depend on other factors such as the overall

apartment size. A larger, well-designed apartment would also be expected to

sell for more than a smaller type. Compare the apartment sizes and floorplans.

Back to our advertised highest

price. Always ask yourself : what types of

apartment is this being compared to? What size, floorplan, level,

outlook, no. bathrooms and carspaces, and what does it include?

It may still be the highest price in

years, but it may be like comparing apples and tomatoes .. they are very

different.

Reader's Comment - Is there a boom?

A reader's view:

There seems to be a dramatic marketing shift going on in Brisbane at present in regard to marketing of apartments and units. The advertising has shifted to promoting the merits of “investing in apartments for rental return” rather than marketing to owner-occupiers. It appears the owner-occupier buyers have all dried up, perhaps they are among the 20,000 workers slated by the State Government for redundancies?

Or are potential owner-occupiers waiting for the release onto the market of thousands of houses and flats currently owned by State and Federal Government that are soon to be placed on the market as a result of the Government push for the private sector to provide (former) public housing by offering the tax-deduction carrot being offered to owners who place rental properties into the NRAS scheme?

One only has to attend the Home Show in Brisbane to see this over-night marketing shift or take a cursory glance at this Saturday’s Courier Mail Property insert. The marketing hype seems to have abandoned the (now) non-existent new owner-occupier buyers and switched to promoting the merits of “investing in units or apartments for rental return” since clearly, the notion of capital gain is now just a pipe dream, at least for the next 5-10 years.

Accompanying press releases and advertisements say how successful the developments are (or going to be – many haven’t even started building) and advertise the numerous sales that have already been made to “investors” for fabulous rental returns. Who is buying these apartments is the question. For example, one in Milton advertises that it has sold $90 million in pre-sales with a vacancy rate of 0.7% and a rental return of 12.4% p.a (Courier Mail Sat 21/7/2012) yet not a sod has been turned on the vacant site. Puzzling indeed.

Others are advertising rental returns of $600-$850 per week around Newstead and Bowen Hills yet a newly completed complex at Bowen Hills, just 2 minutes from the CBD has huge placards visible from the ICB offering rentals at $300 per week. Quite a difference from the advertised rentals of $600-$800 per week available to “investors” less than a kilometre away. Recent data shows around 130 apartments available for lease or sale in the Teneriffe and Newstead area. So while alleged hundreds of units are being “snapped up” by savvy investors cashing in on the “rental boom” (remember the mining boom?) around Brisbane, a number of large unit and/or apartment complexes have been abandoned before they even turned a sod. Puzzling indeed? Yet the marketers claim buyers are scrambling to line up and buy off the plan? More puzzling.

There seems to be a dramatic marketing shift going on in Brisbane at present in regard to marketing of apartments and units. The advertising has shifted to promoting the merits of “investing in apartments for rental return” rather than marketing to owner-occupiers. It appears the owner-occupier buyers have all dried up, perhaps they are among the 20,000 workers slated by the State Government for redundancies?

Or are potential owner-occupiers waiting for the release onto the market of thousands of houses and flats currently owned by State and Federal Government that are soon to be placed on the market as a result of the Government push for the private sector to provide (former) public housing by offering the tax-deduction carrot being offered to owners who place rental properties into the NRAS scheme?

One only has to attend the Home Show in Brisbane to see this over-night marketing shift or take a cursory glance at this Saturday’s Courier Mail Property insert. The marketing hype seems to have abandoned the (now) non-existent new owner-occupier buyers and switched to promoting the merits of “investing in units or apartments for rental return” since clearly, the notion of capital gain is now just a pipe dream, at least for the next 5-10 years.

Accompanying press releases and advertisements say how successful the developments are (or going to be – many haven’t even started building) and advertise the numerous sales that have already been made to “investors” for fabulous rental returns. Who is buying these apartments is the question. For example, one in Milton advertises that it has sold $90 million in pre-sales with a vacancy rate of 0.7% and a rental return of 12.4% p.a (Courier Mail Sat 21/7/2012) yet not a sod has been turned on the vacant site. Puzzling indeed.

Others are advertising rental returns of $600-$850 per week around Newstead and Bowen Hills yet a newly completed complex at Bowen Hills, just 2 minutes from the CBD has huge placards visible from the ICB offering rentals at $300 per week. Quite a difference from the advertised rentals of $600-$800 per week available to “investors” less than a kilometre away. Recent data shows around 130 apartments available for lease or sale in the Teneriffe and Newstead area. So while alleged hundreds of units are being “snapped up” by savvy investors cashing in on the “rental boom” (remember the mining boom?) around Brisbane, a number of large unit and/or apartment complexes have been abandoned before they even turned a sod. Puzzling indeed? Yet the marketers claim buyers are scrambling to line up and buy off the plan? More puzzling.

Tuesday, July 24, 2012

RBA's view

The RBA governor said future economic shocks that would hurt Australia could happen in a number of ways, such as a severe economic slowdown in China and a collapse in dwelling prices.

"The ingredients we would look for as signalling an imminent crash seem, if anything, less in evidence now than five years ago," he said.

"By the same token there are things we can do to improve our prospects or, if you will, to make a bit of our own future luck," he said. "Some of the adjustments we have been seeing, as awkward as they might seem, are actually strengthening resilience to possible future shocks. Higher more normal rates of household saving, a more sober attitude towards debt, a re-orientation of banks funding, and a period of dwelling prices not moving much come into this category," Mr Stevens said.

Read more: http://www.news.com.au/business/we-should-build-on-our-luck-rbas-stevens/story-e6frfm1i-1226433865255#ixzz21XBd1kh4

"The ingredients we would look for as signalling an imminent crash seem, if anything, less in evidence now than five years ago," he said.

"By the same token there are things we can do to improve our prospects or, if you will, to make a bit of our own future luck," he said. "Some of the adjustments we have been seeing, as awkward as they might seem, are actually strengthening resilience to possible future shocks. Higher more normal rates of household saving, a more sober attitude towards debt, a re-orientation of banks funding, and a period of dwelling prices not moving much come into this category," Mr Stevens said.

Read more: http://www.news.com.au/business/we-should-build-on-our-luck-rbas-stevens/story-e6frfm1i-1226433865255#ixzz21XBd1kh4

Oversupply of dwellings in Australia

"The 2011 Census revealed Australia had 7.8 million households, 900,000 lower than the NHSC’s figure, with population also growing by 300,000 less than previously estimated. These figures have come as such a shock that the NHSC chairman has reported that an undersupply could be incorrect. In fact, Morgan Stanley researchers have found that the current 228,000 dwelling undersupply has now become an oversupply of 341,000, a huge turnaround."

See: Don't be dudded by housing data

See: Don't be dudded by housing data

Sunday, July 22, 2012

REIQ: "Rental demand remains strong"

Extracts from an REIQ Press Release from Friday 20 July 2012:

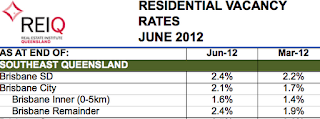

The Queensland rental market remained constricted at the midway point of 2012, according to the latest Real Estate Institute of Queensland’s residential rental vacancy rate survey. The REIQ June vacancy rates - compiled from surveying property managers from REIQ accredited agencies across Queensland - shows demand for rental properties is still exceeding supply in many parts of the State. As at the end of June, rental vacancy rates in many areas remained below 3 per cent, which is considered the equilibrium point of rental supply and demand.

“The first three months of the year are generally the busiest in the Queensland rental cycle so we often see vacancy rates particularly low during this period of time,” REIQ CEO Anton Kardash said. “What our latest survey shows us is that demand for rental property remained strong at the end of June with vacancy rates generally remaining tight. While we are seeing an increase in the number of first home buyers and investors in the sales market, their activity will take some time to flow through to the rental market, which should ease some of this pressure on supply and rents we are now experiencing.”

In Brisbane, the vacancy rate at the end of June was 2.1 per cent, a slight improvement on 1.7 per cent in

March. Inner Brisbane recorded a vacancy rate of 1.6 per cent in June, with property managers from

REIQ accredited agencies reporting some rent increases taking place, especially for houses, due to

stronger demand.

The Queensland rental market remained constricted at the midway point of 2012, according to the latest Real Estate Institute of Queensland’s residential rental vacancy rate survey. The REIQ June vacancy rates - compiled from surveying property managers from REIQ accredited agencies across Queensland - shows demand for rental properties is still exceeding supply in many parts of the State. As at the end of June, rental vacancy rates in many areas remained below 3 per cent, which is considered the equilibrium point of rental supply and demand.

“The first three months of the year are generally the busiest in the Queensland rental cycle so we often see vacancy rates particularly low during this period of time,” REIQ CEO Anton Kardash said. “What our latest survey shows us is that demand for rental property remained strong at the end of June with vacancy rates generally remaining tight. While we are seeing an increase in the number of first home buyers and investors in the sales market, their activity will take some time to flow through to the rental market, which should ease some of this pressure on supply and rents we are now experiencing.”

Hilton Gold Coast - Huge Number of Crashed Contracts

A number of years ago, I "awarded" the Hilton Residents on the Gold Coast as one of the worst apartment investments in SE Queensland. See prior posts. A number of years ago, there were many press releases about how successful the development was, and how many sales were made off the plan to investors. I could not figure out who was buying these apartments, or why, as this development was not in a prime location, and surrounded by vacant shops and topless bars.

Now it has come to light that many of the investors were from outside Australia, and more than 100 purchasers have failed to settle (or about 25% of buyers). Values have dropped dramatically, with apartments sold off the plan for $1.4M now valued at about $800,000. (This book would have been helpful to these buyers.)

A number of purchasers who did settle have not put their apartments into the onsite rental pool with Hilton, and offsite agents are making under the name "H Residences". This shows that rental returns are likely to be poor.

Many apartments on the Gold and Sunshine Coasts have decreased in value since 2008. I know of a recent Juniper beachfront apartment that was sold off the plan for over $1.4M, that remains unsold today at $800,000.

See also this article.

Now it has come to light that many of the investors were from outside Australia, and more than 100 purchasers have failed to settle (or about 25% of buyers). Values have dropped dramatically, with apartments sold off the plan for $1.4M now valued at about $800,000. (This book would have been helpful to these buyers.)

A number of purchasers who did settle have not put their apartments into the onsite rental pool with Hilton, and offsite agents are making under the name "H Residences". This shows that rental returns are likely to be poor.

Many apartments on the Gold and Sunshine Coasts have decreased in value since 2008. I know of a recent Juniper beachfront apartment that was sold off the plan for over $1.4M, that remains unsold today at $800,000.

See also this article.

Shrinking Apartment Sizes

In Brisbane, apartment sizes are shrinking. Newer apartments are smaller than older apartments. Many two bedroom apartments are now less than 85 sqm in total size (including balcony), compared with about 100 sqm five years ago, or 120 sqm ten years ago.

For example, DoubleOne3, a Devine project, has two bedroom, two bathroom apartments that have a total size of 74 sqm including balcony. The "Superior" two bedrooms, on the corners of the building are 105 sqm in total size.

As another example, the size of two bedroom apartments in Mirvac's Park development at Newstead range from 96sqm to 112 sqm. Mirvac builds larger than most developers, to a higher quality. But compare Mirvac's Quay West development in Brisbane from more than 10 years ago. There, the two bedroom apartments were 126 sqm. In Mirvac's Arbour on Grey, from about ten years ago, most of the the two bedrooms were around 109 sqm.

In NYC, the size of new rental apartments is also decreasing, but the size of owner-occupied condos is increasing. See NY Times. I think that a similar distinction will arise in Brisbane, where two bedroom apartments less than 95 sqm in total size will be relegated as investor only product. Moreover, care should be taken when comparing apartments. Often the smaller newer apartments are more expensive than the older, larger apartments.

For example, DoubleOne3, a Devine project, has two bedroom, two bathroom apartments that have a total size of 74 sqm including balcony. The "Superior" two bedrooms, on the corners of the building are 105 sqm in total size.

As another example, the size of two bedroom apartments in Mirvac's Park development at Newstead range from 96sqm to 112 sqm. Mirvac builds larger than most developers, to a higher quality. But compare Mirvac's Quay West development in Brisbane from more than 10 years ago. There, the two bedroom apartments were 126 sqm. In Mirvac's Arbour on Grey, from about ten years ago, most of the the two bedrooms were around 109 sqm.

In NYC, the size of new rental apartments is also decreasing, but the size of owner-occupied condos is increasing. See NY Times. I think that a similar distinction will arise in Brisbane, where two bedroom apartments less than 95 sqm in total size will be relegated as investor only product. Moreover, care should be taken when comparing apartments. Often the smaller newer apartments are more expensive than the older, larger apartments.

Saturday, July 21, 2012

Alex Perry Apartments - Sales Slow?

The developers of the delayed 11-storey Alex Perry Residential apartment block in Brisbane’s Fortitude Valley have removed all three-bedroom apartments from the design and are awaiting council approval on a modified development application. A spokesperson for developer Chrome Property told Property Observer there were few enquiries for the three-bedroom apartments since the project launched in May last year, complete with paparazzi and supermodels. The three-bedders have been replaced with one-bedroom apartments as part of a “redefined product”, and 77 of the 143 apartments will be sold to investors as serviced apartments with a hotel operator lined up to manage them. Investors are being offered 6% guaranteed rental returns for up five years net of management fees, with settlement anticipated for early 2014. Construction is expected to start at the end of the year, with completion in early 2014. One-bedroom apartments will start from $381,000 and two-bedroom units from $550,000. Chrome has been reluctant to reveal sales numbers since the project was launched.

Full Story Here.

Full Story Here.

Suburbs With Most Rental Properties

Brisbane Suburbs With Highest Proportion of Rental Properties:

- Bowen Hills

- The Valley

- Spring Hill

- South Brisbane

- Milton

- Kelvin Grove

- Kangaroo Point

- West End.

See detailed chart here and article from RP Data.

Friday, July 20, 2012

Q1 Trademark

A recent interesting Federal Court decision in favour of Mantra, that decides that the onsite manager can own a trademark for its letting business, even if the trademark is similar to the building name.

See Mantra IP Pty Ltd v Spagnuolo [2012] FCA 769 (19 July 2012):

"Like the Chifley Tower, “Q1” was a sign devised by Sunland, a private entity, to, among other things, signify or name its private building development. When it chose the sign “Q1”, it did not adopt or incorporate a geographical name such as that of an established town, suburb or district, like Surfers Paradise, or the Gold Coast. ... From this history, I do not consider there is any basis upon which any trader could claim to have any “common right of the public” to make honest use of the sign “Q1” as a trade mark. Put differently, there is nothing about the sign “Q1” that could be said to bring it within the “common heritage”..."

See Mantra IP Pty Ltd v Spagnuolo [2012] FCA 769 (19 July 2012):

"Like the Chifley Tower, “Q1” was a sign devised by Sunland, a private entity, to, among other things, signify or name its private building development. When it chose the sign “Q1”, it did not adopt or incorporate a geographical name such as that of an established town, suburb or district, like Surfers Paradise, or the Gold Coast. ... From this history, I do not consider there is any basis upon which any trader could claim to have any “common right of the public” to make honest use of the sign “Q1” as a trade mark. Put differently, there is nothing about the sign “Q1” that could be said to bring it within the “common heritage”..."

Wednesday, July 18, 2012

Residex Property Statistics June 2012

Residex has published its June 2012 statistics chart here. According to Residex, Brisbane apartment median valued decreased by 2.92% in the last financial year, and decreased just over 3% in the prior financial year. Melbourne was down over 4%. The number of sales of apartments in Brisbane increased slightly in this period.

Tuesday, July 17, 2012

South Bank Census Data

One area of Brisbane where there are many apartments is the South Bank area of South Brisbane. However, there is little data available about this area because it is leasehold land. The 2011 Census has some interesting data. The apartments in this area include Arbour on Grey, Saville Southbank (also known as Mantra Southbank) and Urbanest student accommodation.

- population - 804 people

- median age - 22

- Most people are in the 20 to 24 age group (31% of the population)

- 91 families

- 17% married

- 66% have University qualifications (compared with 13.5% for Qld or 14.35 for Australia as a whole).

- 231 dwellings in total (of which, 92% are apartments)

- Average of 2.1 people per household

- 66% of dwellings had 2 bedrooms

- Median weekly household income - $1,687

- 70% of dwellings are rented

- Median rent - $500 per week

- 0.9 cars per dwelling

- Ancestry: "The most common ancestries were English 17.2%, Chinese 16.1%, Australian 11.9%, Irish 5.0% and Scottish 4.7%."

- Country of birth: "In 3111003 (Statistical Area Level 1), 31.4% of people were born in Australia. The most common countries of birth were China (excludes SARs and Taiwan) 6.0%, Hong Kong (SAR of China) 4.9%, Singapore 4.4%, England 4.2% and Korea, Republic of (South) 4.0%."

- 68% had both parents born outside of Australia.

Monday, July 16, 2012

Brisbane City Census Data

For the past few weeks, I have been looking at the 2011 census data. It is very useful for property investors. In my view, the best place to search is via an address search, and the results are then available in layers, from a few blocks, to suburb, post code area, and so on. You can search here.

For Brisbane City downtown area, in 2011, here is some interesting data (full results here):

For Brisbane City downtown area, in 2011, here is some interesting data (full results here):

- population - 7,888 people

- median age - 29

- Most people are in the 25 to 29 age group (22% of the population)

- 1,526 families

- 32% married

- 37% have University qualifications (compared with 13.5% for Qld or 14.35 for Australia as a whole).

- 4,516 dwellings in total (of which, 98.7% are apartments)

- Average of 2 people per household

- 50.9% of dwellings had 2 bedrooms

- Median weekly household income - $1,828

- 54.5% of dwellings are rented

- Median rent - $530 per week

- 0.8 cars per dwelling

- Ancestry: "The most common ancestries in Brisbane City (State Suburbs) were English 18.0%, Australian 11.3%, Chinese 9.8%, Irish 7.0% and Korean 5.8%."

- Country of birth: "In Brisbane City (State Suburbs), 33.3% of people were born in Australia. The most common countries of birth were Korea, Republic of (South) 6.6%, England 4.4%, China (excludes SARs and Taiwan) 3.9%, Taiwan 3.3% and New Zealand 2.5%."

- 63.5% had both parents born outside of Australia

Sunday, July 15, 2012

Population Growth

Population growth often leads to property price growth. Statistics from the 2011 census were released recently, and show the population growth for Queensland. The question is whether this growth will continue, and at what rate.

The official population estimates show that Australia's population was a little under 4.5 million people in 1911 and by 2011 there were 22.3 million people.

The Commonwealth Censuses have also tracked the growth and development of the states and territories that make up the Commonwealth of Australia, as well as recording the distribution of the population between them. In the 100 years between 1911 and 2011, population growth for the two most populous states, New South Wales and Victoria, has largely tracked that of the national population. Both Western Australia and Queensland had relatively consistent shares of the national population until the 1960s and 1970s, when substantial expansion of the economies in both states began to occur, supported at least in part by mining development. Since 1911, Queensland's share of the national population has grown by 6.3 percentage points, while the population share for Western Australia grew by 4.1 percentage points.

See ABS

The official population estimates show that Australia's population was a little under 4.5 million people in 1911 and by 2011 there were 22.3 million people.

The Commonwealth Censuses have also tracked the growth and development of the states and territories that make up the Commonwealth of Australia, as well as recording the distribution of the population between them. In the 100 years between 1911 and 2011, population growth for the two most populous states, New South Wales and Victoria, has largely tracked that of the national population. Both Western Australia and Queensland had relatively consistent shares of the national population until the 1960s and 1970s, when substantial expansion of the economies in both states began to occur, supported at least in part by mining development. Since 1911, Queensland's share of the national population has grown by 6.3 percentage points, while the population share for Western Australia grew by 4.1 percentage points.

See ABS

Saturday, July 14, 2012

Brisbane Apartment property cycle improving: HTW

From HTW's month in review (July):

Brisbane Units as at June 2012:

Stage of property cycle: Start of recovery

Rental vacancy trend: Steady

Demand for new units: Soft

Trend in new unit construction: Steady

Volume of unit sales: Steady

This is the most optimistic that HTW has been in some time.

Brisbane Units as at June 2012:

Stage of property cycle: Start of recovery

Rental vacancy trend: Steady

Demand for new units: Soft

Trend in new unit construction: Steady

Volume of unit sales: Steady

This is the most optimistic that HTW has been in some time.

Friday, July 13, 2012

The most significant barrier to a housing market recovery

"The most significant barrier to a housing market recovery: 301,414 homes for sale.

The number of homes available for sale across Australia has been decreasing; however stock levels remain well above average. Over the four weeks to 8 July 2012 RP Data tracked 301,414 unique properties advertised for sale across the country. While the number of homes available for sale is very high, the volume has been reducing and is actually about -7.4% lower than when supply levels peaked last November. ... Clearly, the large number of homes available for sale is due to a lack of absorption rather than a large number of new listings being added to the market."

See Property Pulse.

There are also a large number of properties that owners want to sell, but cannot, so they have been withdrawn from the sale process and rented out, with the hope that the market improves.

The number of homes available for sale across Australia has been decreasing; however stock levels remain well above average. Over the four weeks to 8 July 2012 RP Data tracked 301,414 unique properties advertised for sale across the country. While the number of homes available for sale is very high, the volume has been reducing and is actually about -7.4% lower than when supply levels peaked last November. ... Clearly, the large number of homes available for sale is due to a lack of absorption rather than a large number of new listings being added to the market."

See Property Pulse.

There are also a large number of properties that owners want to sell, but cannot, so they have been withdrawn from the sale process and rented out, with the hope that the market improves.

Thursday, July 12, 2012

Wednesday, July 11, 2012

Distressed America - A reader’s opinion

This interesting note was sent to me by a reader who recently visited the USA:

I visited America for another road trip during May and June of 2012. I have visited America on at least 12 occasions since the mid 80’s and estimate with reasonable accuracy to have driven in excess of 130,000 miles there by road. My previous recent trips to USA were in mid 2008 when the term “GFC” was unheard of and again in 2010 when the USA was supposedly “over” the GFC. My trips by road have usually led me into the back streets and out of City areas avoiding the tourist strips, where one can enjoy real America and also form a more realistic opinion of the economic situation. Having driven from L.A to San Francisco to Vancouver then down to Salt Lake City then across to New York visiting practically every town and City en-route, it was evident that America is in a serious downward economic decline and that, regardless of what the Government there does to try and improve the situation, it appears to have no effect. With some 12.5 million workers (that’s twelve and a half million) now unemployed in America, the effect on the economy is really “in your face” now.

Visiting 21 States and scores of towns and Cities, it was clearly evident that things had changed radically in America since 2008 and this became a fascination for me, given that I had visited America on many occasions when it was the global powerhouse of the world. I began to seek out and drive around the out- of-town industrial areas, high density housing areas, large and small industrial and commercial areas, shopping centres, apartment blocks and hunted up the local real-estate magazines of each town and City I stopped at along the way. What immediately caught my attention in most States and Cities was the large number of closed restaurants and shopping malls, empty shuttered-up industrial buildings for lease, closed and abandoned factories, abandoned car dealerships yards and the number of residential properties and apartments for sale. The exception all over USA were the large food supermarkets which were doing brisk business.

General internal traveller tourism has evaporated in USA except for large numbers of Australians visiting places like Disneyland, Anaheim, San Fran and New York City. The tourist busses around those Cities are packed full with Aussies making the most of the exchange rate while our tourist industry here is on its knees. Outside of those tourist destinations, it’s a very different story. Once proud manufacturing towns all over America are dead, the motels are closed, shopping centres are boarded up, commercial premises empty, people are unemployed and empty houses and apartments are for sale throughout. Beggars are everywhere now, at gas stations, outside motels, the KFC and every food establishment asking for money to feed themselves. These are not the slick street corner beggars usually seen in San Francisco, these people are genuinely out of work, desperate and hungry and usually have unkempt young kids with them. The minimum legal wage in America is US$7.50 per hour for those who can get work. Many Americans work for less and “tips” are often included by unscrupulous employers desperate to stay in business and are used to gross up to the minimum wage to the legal US$7.50 per hour. For the first time ever in America, in my own experience, waiters are asking for tips, usually saying “ Would you like to leave a tip please”. The union wage system in America has been torn apart. Unions have been removed by sacking an entire work-force and rehiring non-union labour only, with wages slashed to the bone. All over America there are re-hiring billboards offering $10.50 per hour at big high-end department stores, stores that even have shops on 5th Avenue in New York. Half or less than half what they used to earn. Business owners here in Australia may think reducing wages will have benefits in terms of competition etc, etc, however, the results are clearly evident in America. Slashing wages has reduced public spending to zero. Spending starts from the bottom up, not the top down. If people have no job and or no disposable income, they have nothing to spend. Hence business suffers and business soon goes out of business. That’s what has happened in America. The result is thousands of businesses of all kinds out of business, all across America.

States that appeared unaffected by this economic downturn were Nebraska, Iowa and Kansas, all food producing States. It was immediately evident when driving those States that things were different. Restaurants were open and well patroned, new car dealerships aplenty, people were out shopping, mall car parks full and it was easy to conclude the economy there was in reasonable shape. Move 50 miles to the next State however and one can see the difference. Leaving an apparently wealthy State like Nebraska or Iowa and driving to Illinois, once a huge manufacturing centre, the change is evident. I decided to look at Peoria, Illinois. This is the earthmoving and mining equipment manufacturing headquarters of the world, or, once was. I drove to the Komatsu factory, once the largest earthmoving and mining equipment factory in the USA formerly employing 4-5000 people in its hey-day. The employees car park was less than quarter full and where I have in the past, seen row upon row of finished equipment ready for shipping, I saw the frames of just four dump trucks packed for rail. I then visited the Caterpillar factory across the Illinois River. Same again, employees car park less than half full. These two companies are manufacturing the bulk of the equipment for the so called “mining boom” here in Australia. Just a minute, “Mining Boom”?. These two major factories have not increased production space since I was there last in 2006 and one gets the appearance of a declining market. Their workforces have been vastly reduced. If there was a “mining boom” on here, would they not be frantically filling manufacturing demand with factory expansion and increased employment? Not so. Quite the opposite. The curious part here is that this is a location where wages are still unionised at US$37.00 per hour. But 3 bedroom houses in Peoria are just $49,000-$80,000 each for a nice family home.

Dayton Ohio is an example like many major Cities across America. I stayed at a well known motel chain which is my favourite, reasonably cheap and clean with an average of US$40-50 per night. The complex had 140 rooms. On arrival there were 9 cars in the car park at 6.30 at night, peak check in time. This was very common across America this time round. Motels are empty, night after night. The owner was seated on the visitors couch looking sad. Greeting me, I booked in and got talking to him. Turns out he was a franchisee. I asked why there were no cars in the car park. “No customers” he said, (obviously). He said he was not sure if the next car in would be a customer or the Sheriff’s Bailiff. All over America this situation was repeated. Many motel chains had simply shut shop or gone broke, even big motels with 50-100 rooms and an accompanying but now closed restaurant belonging to (a now defunct) restaurant chain.

Shopping centres were another story. In big Cities in locations such as California, (all over) Washington, Salt Lake City, Dayton Ohio, Denver Colorado, big shopping centres and malls were deserted of customers. Usually, it was possible to park a car in the first row after the handicap parks in a 5-acre car park. I went into a huge Target store in Denver. There were 20 cash registers, one was open and I was the only person in line. The store was empty of customers. A walk around the out-door mall complex revealed many small and large stores closed up and empty. This was common all over America. In some Cities, entire shopping centres, the size of Toombul on Brisbane’s north side to give an example of size, were completely closed up and gated off. Factories, large and small are deserted, all with the names of the former occupants intentionally painted over or removed. Car dealers are offering nothing down and zero interest for 2 years followed by 1.2% p.a after that for new cars. Some still have brand new 2010 inventory at giveaway prices. Still, no buyers. Philadelphia, Pittsburgh, Columbus, Detroit, some of Chicago and Cleveland are the same. Detroit, home of Motown music, steel mills and big car manufacturing factories is a fascinating place. Scores of factories are simply abandoned, thousands of homes are deserted, many partially burned down, unemployment is rampant and the downtown CBD is deserted at 5.00pm in the afternoon. Large 20-story office blocks are empty in the downtown CBD. Where are the thousands of office workers that once worked there one may ask? Nowhere to be seen, they are now unemployed. Motown music has survived though. Bethlehem Pennsylvania, was once the home of steel mills, each miles long, employing 15,000 workers. Now they are closed. Allentown Pennsylvania is the same, steel mills closed, thousands of people out of work and no money to buy anything.

House prices in America have fallen and continue to fall. There are no buyers for many reasons. I spoke with a number of real-estate agents there. Some were reluctant to discuss anything but a specific property and would not be drawn on the state of the market. Others were more willing to talk outside the square and predicted falls of another 30% and no capital gain for 5 years, perhaps 10 years. Reasons given were: no buyers, potential buyer inability to accrue a deposit, bank reluctance to lend, high unemployment hence inability to obtain a mortgage, high stock numbers on the market and, an undefined but large “secret sales market”. This secret sales market they claimed, comprised millions of homes and apartments for sale but which were not advertised for fear of bringing down the housing market in entirety. Agents told me to take no notice of the asking price. Many houses and apartments are publically displaying a higher sales price than sellers will accept so the financier doesn’t see the real lower price being asked by the seller and grab it before the seller defaults. The rising unemployment obviously has a flow on effect. Reduction in take home wages and increasing unemployment certainly have had a very detrimental effect on the U.S housing market. Rental affordability is also declining as the more wealthy tenants also become unemployed, making investors nervous and they are selling up rental properties and apartments as their ROI falls, placing further downward pressure on prices.

Where this will all end is not my guess. Stalled spending is detrimental to an economy. Low inflation and interest rates may appear on the surface to be prudent economic management however, these two factors coupled with increasing unemployment and pressure on wages which reduce individual spending also cause a stalled economy. America is a stalled economy with almost zero inflation and near zero interest rates. People have no disposable income, and those who do will not open their wallets, regardless. It is often said in Australia that we follow America in economic matters. Our stock market proves it so daily. I hope not.

It is sad to see a once proud and productive nation in such decline. I hope we can choose our own path here in Australia, make our own decisions and avoid the same mass unemployment and social decline America has today.

Friday, June 29, 2012

Which Way Is The Market Going?

In trying to work out which way the market is heading, I decided to call a number of Brisbane real estate agents who sell apartments. Last week, I call about 10 agents and said that I wanted to sell an apartment that I owned. Eight out of ten said now is a good time to sell, because the market is likely to get tougher or stay flat for a long time. Some said that it would be best if I could hold and not sell, provided that I was prepared to hold for some time. But if I needed to sell in the next few years, then I should sell today.

This week, I called the same agents, and asked if it was a good time to buy, and that I was interested in an apartment that they had listed for sale. I did not tell them it was the same person who called them last week. Eight out of ten said it was an excellent time to buy, as the market was at the bottom, and prices were sharp.

Two real estate agents each time said that they did not know, or did not want to offer an opinion.

So I guess asking real estate agents is not the way to go. But many people seem to rely upon real estate agents when making buying or selling decisions, which is probably not the best thing to do.

The real answer to the question of whether it is a good time to buy or sell is that no one really knows. Another answer is that property is a long term investment, so if you a looking to buy for a short term gain, or need to sell in the near future, then the answer for you may be different than a general, abstract answer.

This week, I called the same agents, and asked if it was a good time to buy, and that I was interested in an apartment that they had listed for sale. I did not tell them it was the same person who called them last week. Eight out of ten said it was an excellent time to buy, as the market was at the bottom, and prices were sharp.

Two real estate agents each time said that they did not know, or did not want to offer an opinion.

So I guess asking real estate agents is not the way to go. But many people seem to rely upon real estate agents when making buying or selling decisions, which is probably not the best thing to do.

The real answer to the question of whether it is a good time to buy or sell is that no one really knows. Another answer is that property is a long term investment, so if you a looking to buy for a short term gain, or need to sell in the near future, then the answer for you may be different than a general, abstract answer.

Wednesday, June 27, 2012

More Affordable and Smaller Apartments

The Courier Mails reports that developers are building apartment buildings with smaller apartments, because that is what is selling today. Does this mean that there will be a shortage of larger, family sized apartments in Brisbane in the future?

From the Courier Mail:

"Developer FKP recently withdrew a development application from Brisbane City Council for a future tower at its Gasworks development at Newstead. It was lodged in 2009 and executive director Mark Jewell said it needed to be revised in line with the present market. The tower, known as Parkside Boulevard, will be released in the next three to five years. Two weeks ago, the same developer released its reworked masterplan for The Mill development at Albion. A change in market conditions early in 2010 saw it refund deposits for units already sold off the plan and designs changed. It has now launched the first tower and is waiting for sufficient pre-sales before it starts construction.

In Brisbane's CBD, Melbourne-based developer Billbergia unveiled

plans to develop the failed Vision site into a 90-storey residential

tower with about 800 apartments, a hotel and a 34-storey commercial

tower.

Bellise at Fortitude Valley had initially been planned as a 199-unit development, but had received a new approval to reconfigure it to a 228-unit development of smaller product.

Citimark's Angus Johnson said the launch of its 200-unit Rivana development at Hamilton would wait until the market was right.

While Stockwell plans to proceed with the 150-unit stage two and 50-unit stage three of its Riverpoint development at West End, it has not yet advised a time frame.

Sunland has preliminary approval for the 47-storey Carrington in Alice St in the City. Managing director Sahba Abedian said there were conditions attached, which they were working through."

From the Courier Mail:

"Developer FKP recently withdrew a development application from Brisbane City Council for a future tower at its Gasworks development at Newstead. It was lodged in 2009 and executive director Mark Jewell said it needed to be revised in line with the present market. The tower, known as Parkside Boulevard, will be released in the next three to five years. Two weeks ago, the same developer released its reworked masterplan for The Mill development at Albion. A change in market conditions early in 2010 saw it refund deposits for units already sold off the plan and designs changed. It has now launched the first tower and is waiting for sufficient pre-sales before it starts construction.

Bellise at Fortitude Valley had initially been planned as a 199-unit development, but had received a new approval to reconfigure it to a 228-unit development of smaller product.

Citimark's Angus Johnson said the launch of its 200-unit Rivana development at Hamilton would wait until the market was right.

While Stockwell plans to proceed with the 150-unit stage two and 50-unit stage three of its Riverpoint development at West End, it has not yet advised a time frame.

Sunland has preliminary approval for the 47-storey Carrington in Alice St in the City. Managing director Sahba Abedian said there were conditions attached, which they were working through."

Friday, June 22, 2012

Falling prices

I have been looking at the listing and sale prices for two bedroom apartments in Brisbane. During the peak of the market, which was about 2008, good quality two bedroom apartments (which were more than 110 sqm in size, and often larger) were selling in the $800,000 range. Now, these same apartments are selling in the mid to low $600,000s. That is a decrease of about 20%. One wonders what would have happened to Vision and Empire Square buyers, where the contract price of two bedroom apartments exceeded $1 million. These buildings did not go ahead, despite Colliers reporting strong presales.

Byron Bay to New York City

A nice story in the New York Times on Sunday about the founder of PlatinumHD.tv, which is used by some real estate agents to promote property. He has moved from Byron Bay to New York, and just rented a new apartment. The story of his search is here: http://www.nytimes.com/2012/06/17/realestate/roominess-takes-on-new-significance.html

Monday, June 18, 2012

Matusik Says Brisbane on the upswing

There is an interesting story in Property Observer by Matusik. In it, he says:

"Market watchers will have their own theories on milestones that signal a change in the fortunes of the real estate market. I, for one, think that Brisbane has turned a corner and is well-positioned on the property clock. ... Too early to call an upturn? Maybe, but the signs are definitely there. Of course, the proof in the pudding is a sustained rise in generic property prices."

I think Matusik is slightly optimistic about Brisbane at present, but that is just my view.

"Market watchers will have their own theories on milestones that signal a change in the fortunes of the real estate market. I, for one, think that Brisbane has turned a corner and is well-positioned on the property clock. ... Too early to call an upturn? Maybe, but the signs are definitely there. Of course, the proof in the pudding is a sustained rise in generic property prices."

I think Matusik is slightly optimistic about Brisbane at present, but that is just my view.

Sunday, June 17, 2012

Luxury Apartments

- New York apartment on Central Park South sold for $70 million.

- Soul Penthouse at Surfers Paradise, in final stages of completion, hoping to sell for $20M.

- Waterfront Newstead for $8,750,000

- Riparian, Brisbane City, for more than $3M

Saturday, June 16, 2012

Prediction: Market to Keep Falling in Brisbane

My prediction for the next four months -- the Brisbane property market will continue to decline. My reasons - (a) There is much uncertainty as to what new taxes and increased taxes Newman will hit property owners with. We will not know until September. (b) There will be many Queensland government employees and contractors who will suddenly become unemployed. This has started to happen, and they are selling their investment properties in distressed situations, and few government workers are buying investments at present due to the uncertainty. It is uncertain whether foreign buyers will be less interested due to the doubling of capital gains tax for non-residents. I am seeing many Brisbane apartments being sold for 10% below recent sales price. Gloomy times ahead.

Friday, June 15, 2012

Oracle Buyers Loose Appeal

A number of off-the-plan purchasers for The Oracle development at Broadbeach refused to settle. One reason they gave for their refusal was that Peppers purchased the management rights for the complex. The purchasers lost their appeals today. There were two decisions, Gough, and Walsh. See also Courier Mail.

"... there is little support for the conclusion that, in addition to the role played by the Oracle name in identifying the apartments to be sold and purchased, there was also a promise by the vendor that Tower 1 be known or described as The Oracle at the date of completion. If such a promise existed, it needed to be inferred and the inference, if it could be drawn, was far from obvious. ... For the above reasons, I would order that the appeals be dismissed and that the appellants’ pay the respondent’s costs of the appeals, including reserved costs if any, on the indemnity basis."

The main reason the buyers did not settle was because the apartments dropped significantly in value between contract signing and settlement. That is a risk of buying off-the-plan, and is not a ground to refuse to settle.

"... there is little support for the conclusion that, in addition to the role played by the Oracle name in identifying the apartments to be sold and purchased, there was also a promise by the vendor that Tower 1 be known or described as The Oracle at the date of completion. If such a promise existed, it needed to be inferred and the inference, if it could be drawn, was far from obvious. ... For the above reasons, I would order that the appeals be dismissed and that the appellants’ pay the respondent’s costs of the appeals, including reserved costs if any, on the indemnity basis."

The main reason the buyers did not settle was because the apartments dropped significantly in value between contract signing and settlement. That is a risk of buying off-the-plan, and is not a ground to refuse to settle.

Newman Targets Property Owners for Tax Increases

Any further financial imposts on property investors is likely to see them pull up stumps and sell their

rental properties, according to the Real Estate Institute of Queensland (REIQ).

The release of today’s audit on the Queensland Government’s finances shows property owners, and investors in particular, have once again been earmarked to financially salvage the State’s fiscal woes. The audit has outlined potential revenue-raising measures including: imposing a $100 levy on all property owners; reducing or removing the concession on land tax; applying a premium transfer duty rate; and increasing the landholder acquisition duty rate.

Acting REIQ CEO Antonia Mercorella said property owners were sick and tired of having to bail out the government. ‘‘Property owners - and investors specifically - seem to forever be targeted by all levels of government when they are short of cash, whether it is through higher council rates, one-off levies or higher rates of stamp duty,’’ she said. ‘‘The additional legislative and compliance obligations on property investors over recent years, coupled with weaker returns on investment, has resulted in many opting to sell their rental properties.’’

Australian Bureau of Statistics (ABS) data shows the number of investors active in the Queensland property market has halved in the last five years. Ms Mercorella said this number was likely to decline even further if investors were slugged with additional costs.

“We are currently starting to see the impact of this reduced investor activity with vacancy rates tightening and rents increasing across the State. If more investors left the rental market, then this situation would undoubtedly worsen,” she said. “If land tax thresholds are reduced or removed, the added costs would put an end to the glimmers of renewed investor activity we have seen in recent months and would also likely be passed onto tenants via increased rents. Also the unit and townhouse market in particular is yet to see investors return significantly with the additional costs associated with this type of housing deterring investors.”

Newman was unfriendly to property owners as Mayor of Brisbane -- he substantially increased rates for apartment owners, and did nothing to reduce spending by Council or the number of council administration workers.

The release of today’s audit on the Queensland Government’s finances shows property owners, and investors in particular, have once again been earmarked to financially salvage the State’s fiscal woes. The audit has outlined potential revenue-raising measures including: imposing a $100 levy on all property owners; reducing or removing the concession on land tax; applying a premium transfer duty rate; and increasing the landholder acquisition duty rate.

Acting REIQ CEO Antonia Mercorella said property owners were sick and tired of having to bail out the government. ‘‘Property owners - and investors specifically - seem to forever be targeted by all levels of government when they are short of cash, whether it is through higher council rates, one-off levies or higher rates of stamp duty,’’ she said. ‘‘The additional legislative and compliance obligations on property investors over recent years, coupled with weaker returns on investment, has resulted in many opting to sell their rental properties.’’

Australian Bureau of Statistics (ABS) data shows the number of investors active in the Queensland property market has halved in the last five years. Ms Mercorella said this number was likely to decline even further if investors were slugged with additional costs.

“We are currently starting to see the impact of this reduced investor activity with vacancy rates tightening and rents increasing across the State. If more investors left the rental market, then this situation would undoubtedly worsen,” she said. “If land tax thresholds are reduced or removed, the added costs would put an end to the glimmers of renewed investor activity we have seen in recent months and would also likely be passed onto tenants via increased rents. Also the unit and townhouse market in particular is yet to see investors return significantly with the additional costs associated with this type of housing deterring investors.”

Newman was unfriendly to property owners as Mayor of Brisbane -- he substantially increased rates for apartment owners, and did nothing to reduce spending by Council or the number of council administration workers.

Monday, June 11, 2012

Park At Waterfront

This weekend, I visited Park at Waterfront, a newly completed Mirvac apartment tower at the Newstead River Park. The area was dark and desolate. The Park building is located behind some car dealers, and other industrial properties. It overlooks a small park and construction site for other buildings. I would not feel safe walking around this area at night. But seeing that there is nothing to walk to, I guess that is not an issue. Why buy or live in an apartment in such an isolated wasteland? The building itself seemed to be a fine looking building, not that many people will see it.

Sunday, June 10, 2012

Recent Apartment Sales in Brisbane

Metro 21 (21 Mary Street)

- Apt 1701, 2 bedrooms, 3 bathrooms, sold furnished $492,500 (rents for $700 per week)

- Apt 1003, 1 bedroom, $310,000

Quay West (132 Alice Street)

- Lot 29, Apt 503, 1 bedroom, 73 sqm total size, sold furnished $450,000

Admiralty Towers One (48 Howard Street)

- Lot 105, 2 bed, 2 bath, on Macrossan Street side, sold on 28 April, $532,500

- Lot 85, 1 bedroom, direct riverfront, sold on 4 April for $562,000

- Lot 141, 2 bedrooms, 2 bathrooms, $535,000

- Lot 31, 2 bedrooms, 2 bathrooms, $615,000

- Lot 5, 1 bedroom, 1 bathroom, on rear of building, for $490,000

Admiralty Quays (32 Macrossan Street)

- Lot 83, 1 bedroom, $580,000

Felix (26 Felix Street)

- Lot 57, 2 bedroom, 1 bathroom, large courtyard, sold for $540,000

- Lot 152, 2 bedrooms, sold for $475,000

- Lot 117, 2 bedrooms, sold for $465,000

- Lot 278, 1 bedroom, no car, sold for $325,000

Casino Towers (151 George Street)

- Apt 1503, 2 bedrooms on front/side, with river and Southbank views, settled in May for $580,000.

- Apt 1603, 2 bedrooms, on front/side with river and Southbank views, $565,000

- Apt 2202, 2 bedrooms, middle front with river and Southbank views, 103 sqm total size - $655,000

- Apt 2107, 2 bedrooms, river views, 93 sqm total size - $515,000

- Apt 2104, 1 bedroom on rear - $362,500

- Apt 3803, 2 bedroom sub penthouse, 188 sqm in size - $805,000

Rent Sales in Charlotte Towers

- Apt 1907, 2 bedrooms, sold on 11 April 2012 for $456,000

- Apt 1104, 1 bedroom, no car, sold on 27 March 2012 for $326,000

- Apt 2808, 2 bedrooms, sold on 25 March for $510,000

- Apt 605, 1 bedroom, sold on 22 March 2012 for $290,000

- Apt 1704, 1 bedroom, sold on 21 March 2012 for $322,500

- Apt 2003, 2 bedrooms, reported as sold on 17 March for $475,000

- Apt 2804, 1 bedroom, sold on 14 March for $350,000

- Apt 1210, 1 bedroom, sold on 12 March for $338,000

- Apt 4108, 1 bedroom, sold on 5 March for $330,000

- Apt 2502, 2 bedrooms, sold on 1 March for $498,000

- Apt 910, 1 bedroom, sold on 29 February for $370,000

- Apt 1904, 1 bedroom, sold on 21 February for $327,000

Saturday, June 9, 2012

Is Median House Price Data Useful?

There are many newspaper reports that discuss rising or falling house & apartment prices by reference to the median sales price for a particular period. For example, see this recent report from REIQ. The median price is the middle price of all the properties sold in the defined period. (For example, if there were 5 sales in the period, for $1, $10, $1000, $1001 and $6409, then the median is $1,000.)

If you select a different length of time to measure the median, you get a different result of course. For example, according to REIQ, the median sales price for Brisbane apartments (all of Brisbane local government area) for January 2012 to March 2012 was $387,750. The median for April 2011 to March 2012 was $395,000.

The median is not the average price. (The average for the example above is $1484.) See also here and here.

The statistics only look at the properties that were sold in the period. If the median changes, it does not necessarily mean that the value of any particular property has changed. For example, if in one quarter, there are many two bedroom apartments that are sold, and in the next quarter, there are mostly one bedroom apartments that are sold, then the median price is likely to decrease. If a new off-the-plan development settles in the period, then the median is likely to increase for that period and decrease for the next period.

So how reliable are the recent REIQ statistics? I had a look at a number of the more larger, upmarket and top end apartment buildings, and there are no or few reported sales for the relevant period (January 2012 to March 2012). For example:

If you select a different length of time to measure the median, you get a different result of course. For example, according to REIQ, the median sales price for Brisbane apartments (all of Brisbane local government area) for January 2012 to March 2012 was $387,750. The median for April 2011 to March 2012 was $395,000.

The median is not the average price. (The average for the example above is $1484.) See also here and here.

The statistics only look at the properties that were sold in the period. If the median changes, it does not necessarily mean that the value of any particular property has changed. For example, if in one quarter, there are many two bedroom apartments that are sold, and in the next quarter, there are mostly one bedroom apartments that are sold, then the median price is likely to decrease. If a new off-the-plan development settles in the period, then the median is likely to increase for that period and decrease for the next period.

So how reliable are the recent REIQ statistics? I had a look at a number of the more larger, upmarket and top end apartment buildings, and there are no or few reported sales for the relevant period (January 2012 to March 2012). For example:

- Admiralty Towers Two - no recorded sales

- The Grosvenor - no recorded sales

- Quay West - only one sale, a 1 bedroom.

- Admiralty Quays - only one sale, a 1 bedroom

- Riparian - 1 reported sale, a 2 bedroom

- Metro 21 - 2 reported sales (1 bedroom & 2 bedroom)

- Admiralty Towers One - no sales on direct riverfront side of building

- Fresh Taringa - no sales since October 2010

- Riva Indooroopilly - no sales in more than 12 months

- For the above, there were no 3 bedroom sales at all.

It seems that the larger and more expensive apartments are not being sold. Thus, the median price will be less than periods where there are more of these apartments that are being sold. That the larger or more expensive apartments are not being sold could be for a number of reasons: (A) They may be listed for sale, but not selling because the owner does not want to or need to decrease price. (B) These buildings have more owner-occupiers, who do not sell as often. (C) If rented, the rents are good, and so selling for a lower price makes less sense than renting out the apartment. (D) An owner who needs to sell may decide to rent the apartment for a short period, until prices rise. (E) There may be no buyers at the high end of the market.

So it is hard to determine if the apartment values have fallen for the kinds of apartments that are not often sold, and if so, by how much. Also, the median price decease for Brisbane may be because of a change in mix of the apartments that are being sold.

Demand strengthens in unit market: REIQ

Press Release from REIQ today: Queensland’s unit and townhouse market experienced strengthening demand over the March quarter,

according to the latest Real Estate Institute of Queensland (REIQ) figures.

The REIQ’s quarterly Queensland Market Monitor found the numbers of preliminary unit and townhouse sales across the State were up 11 per cent compared to the December quarter last year. Over the period, there was also a dramatic increase in the numbers of units sold between $250,000 and $350,000 with sales in this price bracket increasing 22 per cent.

"This increase in more affordable unit and townhouse sales is being driven by demand from first home buyers and investors, who often target properties at the lower end of the market," REIQ CEO Anton Kardash said. "About 19 per cent of homes financed in Queensland are now being bought by first home buyers, which is the highest level of activity from first-time property buyers since 2009 when the First Home Owners Boost was available. Investors too are making a long-awaited return to the market with more than 4,500 properties bought by investors in March this year. The 10-year average is 5,000 dwellings per month so this is also the strongest level of activity from investors since early 2010".

Over the March quarter, median unit and townhouse prices softened in a number of areas due to this shift in demand for more affordable properties. Median prices reflect the types of properties that sell over a particular timeframe so if more affordable properties sell the median will be dragged lower.

Brisbane’s median unit and townhouse price softened 3.1 per cent to $387,750, however sales activity was up more than 20 per cent compared to the previous quarter.

On the Gold Coast, the beachside suburbs recorded the greatest increase in activity, with Surfers Paradise and Broadbeach topping the list.

The Sunshine Coast saw a similar trend with Mooloolaba and Noosaville recording the top increases in sales activity over the quarter. The Sunshine Coast was also the only major region for Southeast Queensland to record an increase in its median, up 2.2 per cent to $332,250.

Although a strong result for the house market was recorded over the quarter, Cairns’ unit market continues to struggle, with sales down 30 per cent. Comments from various regional zone chairs, Cairns included, say that units are proving difficult to sell, as buyers are put off by the increased costs associated with owning a unit, such as body corporate fees, insurance levies and council rates. As such, buyers end up seeing more value in buying a house, with the ongoing servicing costs equalling that of a unit.

The chart below, from REIQ, is for apartments and townhouses only, not houses. Click on chart to make bigger.

Notes for chart

* Medians affected by varying quantities of new properties sold

f Medians affected by varying numbers of waterfront properties sold

- Due to the nature of properties in this suburb, some group titled property sales have been omitted

The REIQ’s quarterly Queensland Market Monitor found the numbers of preliminary unit and townhouse sales across the State were up 11 per cent compared to the December quarter last year. Over the period, there was also a dramatic increase in the numbers of units sold between $250,000 and $350,000 with sales in this price bracket increasing 22 per cent.

"This increase in more affordable unit and townhouse sales is being driven by demand from first home buyers and investors, who often target properties at the lower end of the market," REIQ CEO Anton Kardash said. "About 19 per cent of homes financed in Queensland are now being bought by first home buyers, which is the highest level of activity from first-time property buyers since 2009 when the First Home Owners Boost was available. Investors too are making a long-awaited return to the market with more than 4,500 properties bought by investors in March this year. The 10-year average is 5,000 dwellings per month so this is also the strongest level of activity from investors since early 2010".

Over the March quarter, median unit and townhouse prices softened in a number of areas due to this shift in demand for more affordable properties. Median prices reflect the types of properties that sell over a particular timeframe so if more affordable properties sell the median will be dragged lower.

Brisbane’s median unit and townhouse price softened 3.1 per cent to $387,750, however sales activity was up more than 20 per cent compared to the previous quarter.

On the Gold Coast, the beachside suburbs recorded the greatest increase in activity, with Surfers Paradise and Broadbeach topping the list.

The Sunshine Coast saw a similar trend with Mooloolaba and Noosaville recording the top increases in sales activity over the quarter. The Sunshine Coast was also the only major region for Southeast Queensland to record an increase in its median, up 2.2 per cent to $332,250.

Although a strong result for the house market was recorded over the quarter, Cairns’ unit market continues to struggle, with sales down 30 per cent. Comments from various regional zone chairs, Cairns included, say that units are proving difficult to sell, as buyers are put off by the increased costs associated with owning a unit, such as body corporate fees, insurance levies and council rates. As such, buyers end up seeing more value in buying a house, with the ongoing servicing costs equalling that of a unit.

The chart below, from REIQ, is for apartments and townhouses only, not houses. Click on chart to make bigger.

* Medians affected by varying quantities of new properties sold

f Medians affected by varying numbers of waterfront properties sold

- Due to the nature of properties in this suburb, some group titled property sales have been omitted

Thursday, June 7, 2012

CBRE - Brisbane improving

The Brisbane housing market is starting to experience the benefits of the resources boom but the Gold Coast remains one of the “worse performing markets,” says CBRE in its second quarter south-east Queensland market view report.

The report notes that the Sunshine Coast housing market continues to struggle – though not to the same extent as the Gold Coast market – with both coastal markets not seeing much benefit from the mining boom in central and northern Queensland.

Buyers Now Saying Yes?

"The head of real estate strategy at Macquarie Capital, Rod Cornish, uses an affordability measure that brings together the mortgage rate, the level of house prices and the ability of households to pay.

Many will have seen the Cornish graph already. It is easy to follow: when affordability falls, so does housing activity; when affordability rises, housing follows.

All the elements of affordability are now moving the right way.

House prices have dropped. Mortgage rates are falling. And household income is rising.

But there are lags and hiccups. As Cornish says, mortgage rate moves take six months to have an impact. The two cuts late in 2011 would be boosting housing now if the banks had not cut the shift short with out-of-cycle rate rises."

See AFR Story

But...

"The Reserve Bank of Australia’s rate cuts, which started in November, have not boosted demand in the housing market, meaning one in seven homes bought in the past five years are still worth less than their purchase price."

See Home Buyers Still Uninspired

But...

"The Reserve Bank of Australia’s rate cuts, which started in November, have not boosted demand in the housing market, meaning one in seven homes bought in the past five years are still worth less than their purchase price."

See Home Buyers Still Uninspired

Subscribe to:

Posts (Atom)