Thursday, March 31, 2011

Admiralty Two and Mosaic management rights for sale

Housing Flat in February - almost no growth over past year

From RP Data Press Release today:

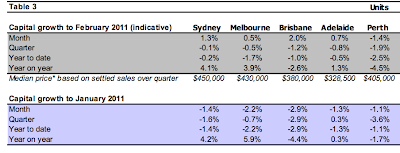

After a natural disaster-affected January (-1.5 per cent seasonally-adjusted or -0.7 per cent raw), RP Data-Rismark's Hedonic Index reports that Australian home values held ground during the month of February.

In the capital cities, RP Data-Rismark recorded flat dwelling values (0.0 per cent seasonally-adjusted or a slightly stronger +0.7 per cent in actual 'raw' terms). The 'rest of state' areas, which account for the 40 per cent of homes not located in the capitals, also displayed some improvement during February with house values rising by 0.5 per cent seasonally-adjusted (+0.3 per cent raw).

Over the 12 months to end February, Australia's capital city home values have hardly moved, rising by only 0.8 per cent. The story is the same in the rest of state regions, where home values remain unchanged (-0.2 per cent) over the last year.

In the property investment market, RP Data-Rismark estimate that gross apartment and detached house yields were 4.8 per cent and 4.2 per cent, respectively, in February. Darwin (5.7 per cent), Canberra (5.3 per cent), Sydney (5.1 per cent) and Brisbane (5.1 per cent) all offer reasonable rental yields in the apartment market. Melbourne is the laggard at 4.2 per cent. ...

A (near) double interest rate hike in November 2010 combined with numerous natural disasters has conspired to make the last three months difficult ones for Australia's housing market. ... While the weakness has been evidenced right across the nation, it has been especially acute in Darwin (-9.0 per cent) and the two resource-centric capitals, Brisbane (-3.3 per cent) and Perth (-1.9 per cent).

"Recent RBA analysis also shows that repossessions have been highest in Perth and South East Queensland, which helps explain the poor performance seen in these states. Indeed, Perth home values remain 0.7 per cent below their December 2007 levels", Mr Kusher added.

Over the 12 months to February, Sydney (+3.3. per cent), Melbourne (+2.5 per cent), Canberra (+0.7 per cent) and Adelaide (+0.6 per cent) have ground out modest capital gains. In contrast, Brisbane (-5.3 per cent) and Perth (-4.1 per cent) have experienced more material corrections. ...

According to RP Data's Mr Kusher, the key leading indicators indicate that capital growth is likely to remain very subdued for the time being, as Rismark and RP Data have previously forecast.

"Auction clearance rates have been a little weak, the number of homes advertised for sale is at the highest level it has been since we started collecting this data, and other lead indicators, such as the time it takes to sell a home, and the margin by which vendors have to discount their properties, are climbing again after reaching a plateau in recent months. Conditions are certainly in the favour of prospective investors. The large stock of homes available for sale should afford potential buyers increasing scope to negotiate on price and get the best possible deal," Mr Kusher said.

Tuesday, March 29, 2011

Yield

Given the past performance and recent volatility of the rental market, which has occurred despite low vacancy rates, investors should be factoring both negative and positive rental-growth scenarios when making purchasing decisions.

Prospective off-the-plan buyers should also consider what kind of apartment stock and how much is planned in their immediate area, which could affect demand and rental levels by the time their unit is put on the market."

From Domain

Sunday, March 27, 2011

How Many Apartments for Sale in Brisbane?

- Quay West: 4 apartments for sale (two 2 beds; two 1 beds).

- Admiralty Quays: two 2 beds

- Admiralty Towers: one 2 bed at rear

- Admiralty Two: one 2 bed; one three bed

- Arbour on Grey: 2 apartments for sale (one 2 bed; one 3 bed).

- Saville SouthBank: zero

Wednesday, March 23, 2011

Soul Settlements Coming Up

Soul off-the-plan purchasers in the low rise section are getting ready for settlement. Soul is located at Surfers Paradise, in a prime location. It is a very high end high rise. Photo from March showing progress.

Valuers and banks for purchasers are looking at contracts and doing valuations. I have heard of a situation where the apartment was valued at 70% of the contract price. That may not seem to bad, but if the contact price is $2M, then the purchaser needs to find an extra $600,000 to settle.

And there has been no announcement of who will manage this complex.

Will Juniper survive, or head the same way as Raptis and Niecon?

One purchaser is trying to resell his 2 bed apartment for more than a 3 bed apartment is being valued at: www.soul-apartment.com/

Tuesday, March 22, 2011

Developments at Portside

Properties Advertised For Sale

Takeover Bid For Oaks

Rough Ride For Property

At the other end of the auctioneer's hammer, stubborn vendors are reluctant to reduce prices."

See Domain

Saturday, March 19, 2011

Tennyson Reach - Legal Decisions

"As already noted, Mr Cox values the apartment at $1,500,000 and said that its value would have been $1,750,000 had the view been the equivalent of that from the display centre. " Mirvac v. Holland

"The defendant [Mirvac] is in possession of the apartment. After the flood, it removed the mud. The walls of the apartment consisted of Gyprock sheeting. The defendant removed the lower level of the Gyprock, which was flood affected. Wiring was disconnected; switches were removed and piled into a heap; appliances were disconnected. Dunworth v. Mirvac

"It is that the area of a part of the actual Lot varies by more than five per cent from the area depicted upon the drawing for that part. In this case the area of each of the balconies varies from what was shown within the original drawing by, in one case, 10.35 per cent and in the other by 15.30 per cent. Because clause 6.3(a) of the proposed (and actual) contract permitted a change up to five per cent to the “size of the Lot or any part of the Lot” it is argued that these changes made the actual Lot different from the proposed Lot as originally identified." Mirvac v. Beioley

Q1 Legal Decision - Purchaser Looses Large Deposit

Top End Brisbane Apartments

Tuesday, March 15, 2011

Another Dog Decision

Riverpoint Flood Clean Up

The body corporate has prepared a damage report and a preliminary estimate of costs for the clean-up, hire of plant and equipment, purchases involved in the clean-up, temporary electrical power and supply, pump equipment, rubbish disposal, repairs to the electricity supply and switchboards, repairs to ducting and air-conditioning, replacement of pumps and sensors, repairs to sewer and stormwater pumps, repairs to 8 lifts and replacement of lift equipment, pool pumps, entry roller door, fire doors, painting and “miscellaneous.”

The total estimate is $551,341.35 including supervision and co-ordination of the repairs, exclusive of GST."

See decision regarding Riverpoint at West End.

Tennyson Reach Clean Up

Oaks Dives

Sunday, March 13, 2011

Noosa

As pressure mounts on sellers some under siege from banks prices of homes in the iconic playground for the rich and famous have dropped.

Prominent agent Tom Offermann said that for "those with confidence" this was a defining moment. "You can buy well and reap the rewards," he said. "Stock is up 20 per cent on normal levels, buyers are down about 30 per cent and there's good value."

Mr Offermann said the reason behind the downward shift was that Noosa had a high concentration of "discretionary properties" holiday and investment homes that people looked to dispose of in uncertain times. However, he said the area coped better than other hotspots and would bounce back faster.

Mr Offermann's agency recently sold a duplex apartment at 2/11 Mitti St, Little Cove, for $2.015 million for sellers who had acquired it in 2006 for $2.43 million a reduction of 17 per cent.

A stunning waterfront unit in Las Rias on Noosa Sound is listed at $1.95 million 22 per cent below the 2008 value of $2.5 million."

Saturday, March 12, 2011

New Developments Blog

Mirvac at Portside

Gold Coast Sinking Under Apartments Glut

- 2000 apartments worth an estimated $2 billion listed for sale

- few buyers

- dire oversupply

- only 300 apartments are selling on average each year

- between 5 and 7 year supply of apartments

- high asking prices and a reluctance by banks to lend had compounded the oversupply problem

- NAB less likely to lend to the Gold Coast apartment market

- Mr Korda, receiver for The Oracle, estimates average apartment price for the past 10 years has been about $400,000, while the average price for an Oracle unit is $1.2M.

- Soul will add to the glut, where the average asking price for the top third of the 77 storey building is $3.87 million.

- "If you have a $1 million apartment, you could probably only get bank finance for $360,000" Mr Korda said.

- Its a price point and liquidity issue.

Friday, March 11, 2011

REIQ Sales Report

| Region | Median Sale Q4.10 | Qtrly change | Median Sale 12mths Q4.10 | Median Sale 12mths Q4.09 | 1yr change |

| BNE (SD) | $380,000 | 1.3% | $379,950 | $362,000 | 5.0% |

| BNE (LGA) | $400,500 | -1.8% | $407,000 | $386,500 | 5.3% |

| AUCHENFL | $447,500 | 4.1% | $430,000 | $430,000 | 0.0% |

| BNE CITY | $485,000 | -4.9% | $460,000 | $423,500 | 8.6% |

| CHERMSIDE | $415,000 | 8.1% | $426,250 | $407,500 | 4.6% |

| The VALLEY | $375,500 | -4.9% | $400,000 | $402,500 | -0.6% |

| INDO | $460,000 | 2.4% | $465,000 | $435,000 | 6.9% |

| KANGAROO PT | $408,000 | -25.8% | $505,000 | $450,000 | 12.2% |

| NEW FARM | $531,500 | 4.2% | $525,000 | $460,000 | 14.1% |

| PADDO | $407,500 | N/A | $420,000 | $444,000 | -5.4% |

| Sth BNE | $472,500 | 2.3% | $445,000 | $399,250 | 11.5% |

| SPRING HILL | $391,063 | 10.9% | $390,000 | $390,000 | 0.0% |

| ST LUCIA | $447,065 | 5.2% | $440,000 | $448,750 | -1.9% |

| TARINGA | $427,500 | -2.8% | $426,750 | $399,500 | 6.8% |

| TOOWONG | $407,000 | -4.3% | $435,500 | $415,000 | 4.9% |

| WEST END | $520,000 | -3.0% | $530,000 | $509,000 | 4.1% |

Construction Costs

Fairfax Says, Don't Trust Real Estate Agents

REIQ Queensland Unit Report

"The Queensland unit and townhouse market held its ground over the December quarter last year, even as the number of investors and first home buyers remained relatively subdued.

Completing a trend throughout 2010, the last three months of the year were characterised by lower overall buyer demand, particularly from the type of buyers who typically target the unit market.

Similar to the house market over the December quarter, Real Estate Institute of Queensland (REIQ) figures show unit sales across the State easing over the quarter however some regions fared better than others.

“The unit and townhouse market at the end of last year was impacted by less overall demand from investors as well as the lower number of first home buyers in the market compared to the same period in 2009,” REIQ acting CEO Ian Murray said.

“Although we have experienced a number of natural disasters in Queensland in the beginning of 2011, it is hoped that the steady interest rate environment and the stable property pricing that now appear to be in play will result in a strengthening unit and townhouse market by year’s end.”

...

In Brisbane and surrounds broadly, a drop in the number of unit and townhouse sales occurred predominantly within the $350,000 to $500,000 price bracket which is the price range usually targeted by first-timers and investors.

The inner city continues to be the most sought after for units in Brisbane with Brisbane City recording 76 preliminary sales, New Farm recording 48 preliminary sales, and Fortitude Valley recording 33 over the period.

Over the December quarter on the Gold Coast it was the bottom and top end of the market that performed the best with preliminary sales increasing in the sub $250,000 price bracket and the $1 million-plus price bracket compared to the September quarter. Surfers Paradise and Broadbeach were the star performers with each recording 20 more preliminary sales than the previous quarter.

On the Sunshine Coast, Sunshine Beach and Caloundra recorded increases in preliminary sales numbers, while the region as a whole saw unit sales numbers hold steady."

Saturday, March 5, 2011

Reaction to The Economist article

Friday, March 4, 2011

56% over-valued!

"Australian house prices remain the most overvalued in the world, according to the latest quarterly ranking of global house prices by The Economist magazine.

Based on a historical gauge of home prices to rents between 1975-2010, the magazine estimates that Australian residences are 56 per cent over-valued, exceeding the 54 per cent over-priced rate in Hong Kong and 48 per cent in France.

"There may be good reasons for Australian prices to have risen so far, but people made similar, and ultimately incorrect, arguments for the run-up in prices in the West,"The Economist said in a statement accompanying the survey's release."

See SMH

Colliers Research Report - Brisbane Apartments Q4 2010

"Transaction activity in the new Inner Brisbane Apartment market is currently being driven principally by demand from investors. Recently owner-occupiers have been largely absent from the market due in part to expectations of flat prices in the short to medium term, higher borrowing costs and the removal of fiscal stimulus measures.

Currently investors are accounting for 80-90% of all transactions in the new Inner Brisbane apartment market. Investor demand - which is driven largely by rental return and expected capital appreciation - is even stronger for affordable stock (less than $650,000). Notably, the market generally is strong for price-pointed affordable stock.

Returns, which ultimately drive transaction activity for investors, are highly sensitive to both rental values and borrowing costs. Currently, both of these variables are delicately balanced, with rental values sensitive to current and future levels of supply and borrowing costs dependent on the bank’s cost of capital and macroeconomic factors such as inflation. In the near term, investor returns are likely to be driven by rental income rather than capital growth.

Given the current market imbalance, stemming mostly from elevated supply in Inner Brisbane, owner occupiers have become increasingly cautious before committing to purchase. In addition, there is now less urgency to purchase as the strong levels of capital growth witnessed in recent years have dissipated.

Despite the aforementioned threats to performance, the fundamentals of the new Inner Brisbane apartment market remain reasonably solid and underlying demand has held up well. This is reflected by the number of unconditional sales over 2010, which are well above trend levels. However, the ability and/or willingness of both investors and owner-occupiers to purchase has been eroded by increased borrowing costs and expectations in the near term of flat prices and limited rental growth. Whilst some rental markets will be influenced in the short term by home owners displaced by the floods, a sustained increase in tenant demand will be required to deliver solid levels of rental growth.

The annual demand for new apartments in Inner Brisbane is rising, as reflected by the number of unconditional sales reported during 2010 (1,433). The number of transactions in the year to December 2010 is now at its highest level since December 2005 and is well above the long term average for this market. Similarly, demand continued at trend levels over the final quarter of 2010, with 339 unconditional sales.

On the supply side, the number of new apartments available for sale in Inner Brisbane rose to 2,228 during Q4 2010, representing an increase of 24% from the previous quarter. More importantly, available supply is now at its highest level in over 10 years and is well above previous highs observed in 2002 and 2004 (circa 1,500 apartments). Current levels of available supply in Inner Brisbane represent 19 months of demand, based on the average number of unconditional sales witnessed over 2010.

Like many property markets – both residential and commercial - the New Inner Brisbane Apartment market is experiencing the impacts of a misalignment between the business cycle and development cycle. Economic conditions turned down sharply in 2009 and are yet to fully recover, whilst the supply pipeline has retained its strength, resulting in a significant market imbalance.

Most of the new apartments currently for sale in Inner Brisbane are located in the CBD and Inner North, which account for 34% and 41% of the total respectively. Additionally, when we include our estimates of apartments which are likely to be released during 2011, the Inner North and CBD continue to account for the largest share of supply.

The weighted average price of unconditional sales has been trending downward since late 2008. Despite above trend levels of demand during 2010, prices have continued to fall, although the pace of decline has eased significantly. Continued recent falls in the weighted average sale price are a reflection of the large proportion of price pointed affordable stock that transacted during 2009 and 10. The weighted average price of unconditional sales for Inner Brisbane during Q4 2010 was $556,200, a moderate increase from the previous quarter.

The unconditional sales of new apartments in Inner Brisbane during Q4 2010 were comprised largely of affordable stock, with 84% of transactions involving properties less than $650,000 in price. More specifically, 42% of the unconditional sales in the fourth quarter involved properties less than $450,000 in price. Evidently, purchasers continue to be very price conscious and this trend is likely to continue in the near term. Fourth quarter transactions in Inner Brisbane were dominated by one and two bedroom stock, with each category accounting for 45% of the unconditional sales reported.

The number of unconditional sales in the Brisbane CBD rose substantially over the final quarter of 2010, increasing to 94, which is more than twice the average witnessed during 2010 (45). Most of the sales were achieved by Meriton projects, with Infinity and Soleil accounting for 61 and 30 sales respectively. Furthermore, the majority of transactions involved two and one bedroom apartments, with 65% and 21% respectively of the total. The CBD precinct achieved 28% of the sales reported for the new Inner Brisbane Apartment market during Q4 2010 and 12% of the 2010 total. In annual terms there were 179 unconditional sales for the Brisbane CBD during 2010.

The CBD precinct represents a large component of available supply in Inner Brisbane, with 34% of the total (758 apartments). Supply levels are expected to rise substantially during 2011 due to the expected release of some 875 units.

Future Projects

Colliers International Research has estimated approximately 4,000 apartments will be released within Inner Brisbane during 2011.

Approximately 45% of this supply is expected to be located within the Inner North precinct. Madison on Mayne will release the largest number of apartments to the market (286).

The CBD precinct is likely to receive 21% of the potential supply with Camelot providing 420 apartments.

Resales of Existing Apartments

- During the third quarter of 2010, the number of apartments (new and established) which settled in Inner Brisbane fell by 12% to 1,191.

- The number of settlements in Q3 2010 was significantly lower (-23%) than the equivalent quarter of 2009 (1,357).

- Buyers continue to be very price conscious, as reflected by the large number of settlements involving affordable stock, with almost 80% involving apartments less than $600,000 in price."

Metro 21 Sales

|

|

|

Australand's New Riverfront Project

The $55 million first stage of the Hamilton Reach project features 78 residential apartments across two five-storey buildings and will initially create up to 80 full time construction jobs. Once complete, the Northshore development will comprise around 800 apartments and townhouses across 530 metres of elevated riverfront living, about 6 kilometres from Brisbane’s CBD.

The Promontory stage of Yungaba is around 60 per cent sold totalling $30 million. The project was initially met with some resistance from the community, particularly the Yungaba House Action Group who believed the redevelopment of the heritage building wasn’t in the interest of the public. Fulcher says the protests are well behind the company and the project will preserve the cultural value."

"Pressure Grows on Gold Coast"

Thursday, March 3, 2011

HTW Month in Review - March 2011

"Prudent buyers are seeking out prime beachside locations and purchasing both units and dwellings at prices up to 50% discount from there peak in late 2007.

The ‘Buyers Market’ which has been created by and oversupply properties has seen a steady decline in value levels throughout late 2010 and into 2011 with Iocal agents reporting buyers are willing to purchase if they feel a large enough discount has been given. This is very evident with local agents advising cash contracts being offered at open homes which are not subject to finance."

AMP Capital Steps In To Vision Site

Tuesday, March 1, 2011

RP Data - Rismark January Report

Rismark's joint Managing Director Ben Skilbeck added, "There are growing signs of a soft recovery in the housing market after six months of flat dwelling values since May 2010. Housing credit growth looks to be rising a little, and the early auction clearance rate data in February has been a demonstrable improvement over the sub-50 per cent clearance rates at the end of last year. Our forecasting model implies low single digit capital gains in 2011 based on the assumption that the RBA tightens monetary policy further However it is noteworthy that the futures market is not pricing in the first full interest rate increase until February 2012. If the RBA stays on the sidelines in 2011 there will be material upside risks to our forecasts."

Over the twelve months to the end of January, Perth (-3.8 per cent), Brisbane (-3.7 per cent) and Canberra (-0.6 per cent) recorded a decline in home values.

Brisbane had a 5.2% decline in apartment prices over the past twelve months.

See RP Data Press Release and Domain article and Courier Mail